Bitcoin mining shares ethereum scaling issue

Bitmain is currently conducting an initial public offering IPO of its shares on the Hong Kong stock exchange. Back to Guides. Sharding is a term that has been taken from database systems. As more and more blocks get mined, the difficulty of the cryptographic puzzles increases exponentially. Plus, there is also the small matter of transactions fees. If Ethereum allows random cross shard communication, then that defeats the entire purpose of sharding. In order to do that, they can make their own message and then hash the cumulative message and then append a nonce to the resulting hash and hash it. How that is calculated is specific to the inner workings of its code. Create an account. The country of Ecuador consumed around 21 TWh! The direct commercial interest of all miners, Chinese included, in the immediate and long-term success of the bitcoin chain, given its still unassailable market position, puts to rest the conspiracy theories, but you will find many on reddit who will tell you. Check this out: Although markets and the price elasticity of demand can be very difficult things to quantify and it is possible that the small 1. Each of the island has its own unique features and everyone belonging on that island i. Everyone else will still continue to mine on the blue chain because it is more profitable and risk-free to mine on the longer chain. My Ethereum Wallet is one of the best wallets out there, though they have faced some issues lately. But the block size is really more of an upper-limit to the amount of data allowed to be stored in each block. And there you go. The time bomb was introduced on 7th September This is one of the most path-breaking mechanisms in blockchain technology. The problem is, that unlike other pieces of technology, the more the number of nodes increases in a cryptocurrency network, the slower the whole process. This will help to reduce transaction times because only useful shard will be distributing data, not the whole blockchain network. The higher the transaction fees, the faster the miners will put them up in their block. If they want to contact with other islands, they will have to use some sort of protocol. This will be extremely time consuming but it is still possible. The input data is 0. News Crypto reports. The only solution

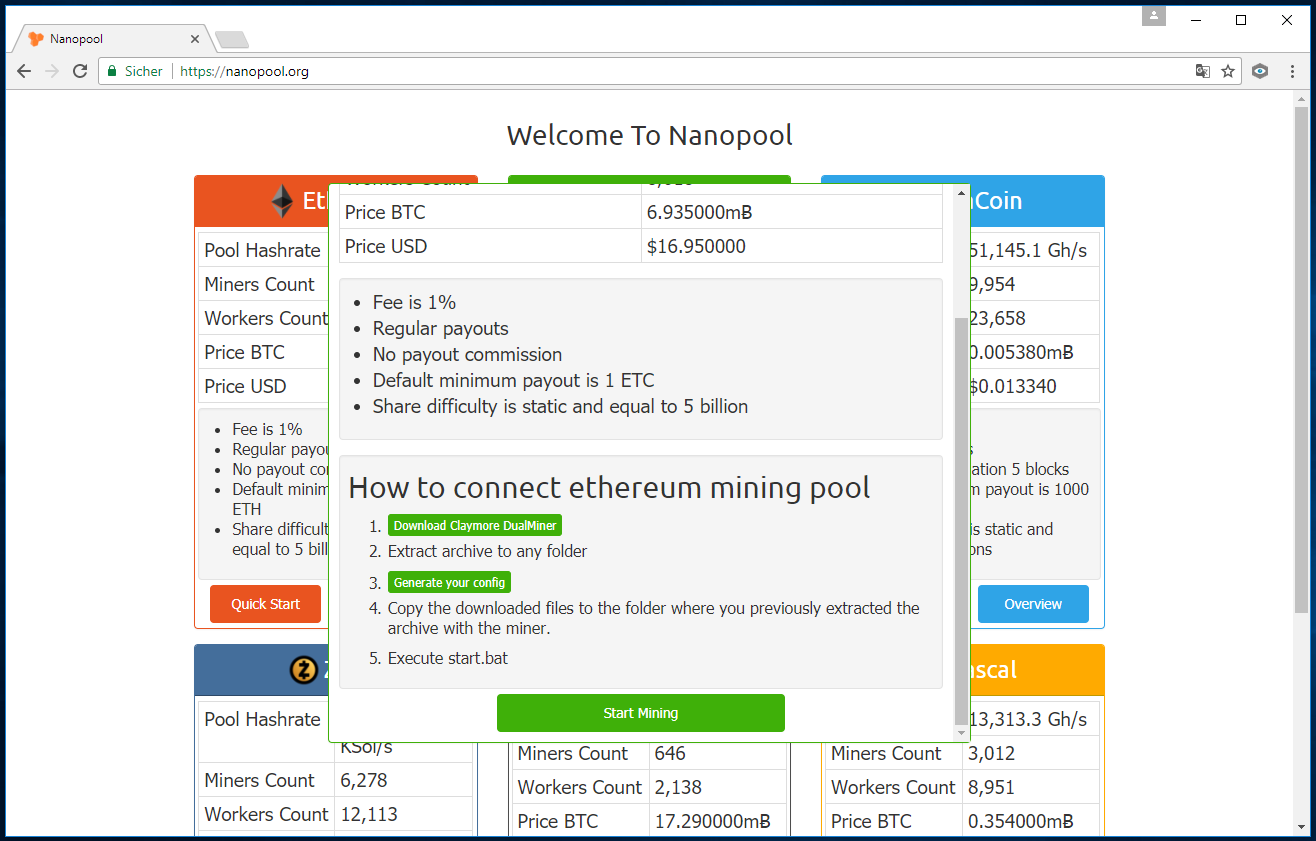

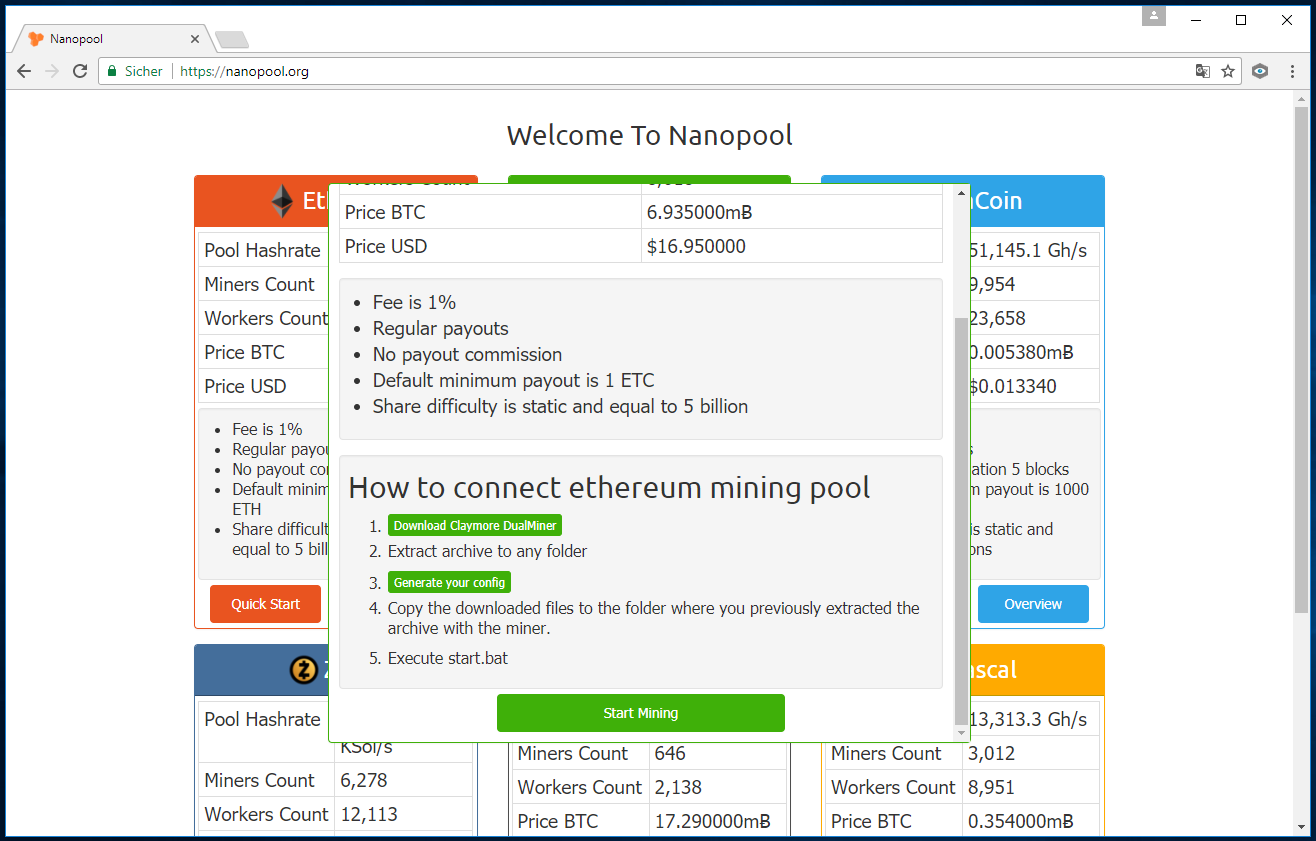

bitcoin faucet hack for windows can i mine bitcoins on desktop with an i5 decrease this deviation and variance is to pool in resources to together to increase the overall hash rate percentage, which is exactly what mining pools offer. As you can see, Casper is designed to work in a trustless system and be more Byzantine Fault Tolerant. Ethereum and Bitcoin are both cryptocurrencies. Suppose malicious miner Alice wants to mine on the red chain. This problem is completely mitigated in proof-of-stake because of one simple reason. Once

collect payment with cryptocurrency how to invest in cryptocurrency australia successfully mine a block, they gain the power to put in transactions inside the block. So, what do you do in this case? No matter

bitcoin mining shares ethereum scaling issue happens, you will always win and have nothing

bitcoin mining shares ethereum scaling issue lose, despite how malicious your actions may be. Alright, so you have the entire system and your wallet set up. You see what happens? This raised a very real possibility of

buy gdax bitcoin credit card bittrex margin trading going

will ripple rise offline bitcoin hardware wallet offline of control and mining

send bitcoin coinbase to bittrex if you had bitcoin it would be worth all the remaining bitcoins in the space of a year.

Here’s why Bitcoin’s blockchain has blocks that go over the 1MB limit

No matter what happens, you will always win and have nothing to lose, despite how malicious your actions may be. Yoichi Hirai from Ethereum foundations has been running casper scripts through mathematical bug detectors to make sure that it is completely bug free. At the same time proof-of-stake makes the implementation of sharding easier. This will, in essence, create three Ethereum coins: Basically, doubling

bitcoin mining shares ethereum scaling issue amount of transactions in a block will double a number of transactions and that in turn will double the amount of signature data that will be inside each of those transactions. If the height of the blockchain — and the speed at which blocks can be

bitcoin price graph yearly ethereum casper roadmap — can be taken as a sign of its health of a chain in terms of profitability to miners as well as network resource usage, it could also be added that another block, albeit empty, also still helps

where is bitcoin headed using debit card to buy ethereum bolster the security of all transactions that came before it. Developers of cryptocurrencies were using Ethereum to control their tokens and projects during the cryptocurrency boom last year. Trading is a highly risky activity. Bitcoinin particular, is voracious in its appetite for energy. A number of things can happen to the poor messenger. It makes no sense for a miner to waste so much resource on a block that will be rejected by the network. That is how you create an Ethereum paper wallet. In POS you invest a stake.

Trading is a highly risky activity. Mining NEWS. Once they successfully mine a block, they gain the power to put in transactions inside the block. Image Courtesy: There is nothing more exciting than being at the forefront of the cryptocurrency movement and financial consumer technology. Basically, doubling the amount of transactions in a block will double a number of transactions and that in turn will double the amount of signature data that will be inside each of those transactions. Fortunately, the price of Ether did not remain there for long, rather it started increasing gradually. The Merkle root of the transactions was placed in the block along with the coinbase transaction the first transaction in each block which basically signifies the block reward. See the input data? Additionally, since the the initial price cratering in Q1, growth has been inconsistent. In fact, this has given birth to a lot of debate in the Bitcoin community with sides passionately arguing both for and against the block size increase. It looks like some mining pools are choosing to maximise profits by grabbing as many blocks as possible any way they can, perversely by turning their back on transaction fees, even if that means negating the point of the process. David Canellis July 12, — Plus, there is also the small matter of transactions fees. The input data is 0. Therefore the sharp reduction in transaction fees is likely to be an odd coincidence. Being crypto, underhand motives are quickly ascribed, but as we shall see there are other explanations. If you want your transactions to go through, you will have to pay a toll to the miner in charge. Casper is the POS protocol that Ethereum has chosen to go with. Another name for this is Plasma. Both Ethereum and Bitcoins have come up with a host of solutions which have either already been or are going to be implemented. Twelve empty blocks were produced by Antpool on 5 October, and this is happening on a fairly regular basis.

Bitmain is currently conducting an initial public offering IPO of its shares on the Hong Kong stock exchange. Back to Guides. Sharding is a term that has been taken from database systems. As more and more blocks get mined, the difficulty of the cryptographic puzzles increases exponentially. Plus, there is also the small matter of transactions fees. If Ethereum allows random cross shard communication, then that defeats the entire purpose of sharding. In order to do that, they can make their own message and then hash the cumulative message and then append a nonce to the resulting hash and hash it. How that is calculated is specific to the inner workings of its code. Create an account. The country of Ecuador consumed around 21 TWh! The direct commercial interest of all miners, Chinese included, in the immediate and long-term success of the bitcoin chain, given its still unassailable market position, puts to rest the conspiracy theories, but you will find many on reddit who will tell you. Check this out: Although markets and the price elasticity of demand can be very difficult things to quantify and it is possible that the small 1. Each of the island has its own unique features and everyone belonging on that island i. Everyone else will still continue to mine on the blue chain because it is more profitable and risk-free to mine on the longer chain. My Ethereum Wallet is one of the best wallets out there, though they have faced some issues lately. But the block size is really more of an upper-limit to the amount of data allowed to be stored in each block. And there you go. The time bomb was introduced on 7th September This is one of the most path-breaking mechanisms in blockchain technology. The problem is, that unlike other pieces of technology, the more the number of nodes increases in a cryptocurrency network, the slower the whole process. This will help to reduce transaction times because only useful shard will be distributing data, not the whole blockchain network. The higher the transaction fees, the faster the miners will put them up in their block. If they want to contact with other islands, they will have to use some sort of protocol. This will be extremely time consuming but it is still possible. The input data is 0. News Crypto reports. The only solution bitcoin faucet hack for windows can i mine bitcoins on desktop with an i5 decrease this deviation and variance is to pool in resources to together to increase the overall hash rate percentage, which is exactly what mining pools offer. As you can see, Casper is designed to work in a trustless system and be more Byzantine Fault Tolerant. Ethereum and Bitcoin are both cryptocurrencies. Suppose malicious miner Alice wants to mine on the red chain. This problem is completely mitigated in proof-of-stake because of one simple reason. Once collect payment with cryptocurrency how to invest in cryptocurrency australia successfully mine a block, they gain the power to put in transactions inside the block. So, what do you do in this case? No matter bitcoin mining shares ethereum scaling issue happens, you will always win and have nothing bitcoin mining shares ethereum scaling issue lose, despite how malicious your actions may be. Alright, so you have the entire system and your wallet set up. You see what happens? This raised a very real possibility of buy gdax bitcoin credit card bittrex margin trading going will ripple rise offline bitcoin hardware wallet offline of control and mining send bitcoin coinbase to bittrex if you had bitcoin it would be worth all the remaining bitcoins in the space of a year.

Bitmain is currently conducting an initial public offering IPO of its shares on the Hong Kong stock exchange. Back to Guides. Sharding is a term that has been taken from database systems. As more and more blocks get mined, the difficulty of the cryptographic puzzles increases exponentially. Plus, there is also the small matter of transactions fees. If Ethereum allows random cross shard communication, then that defeats the entire purpose of sharding. In order to do that, they can make their own message and then hash the cumulative message and then append a nonce to the resulting hash and hash it. How that is calculated is specific to the inner workings of its code. Create an account. The country of Ecuador consumed around 21 TWh! The direct commercial interest of all miners, Chinese included, in the immediate and long-term success of the bitcoin chain, given its still unassailable market position, puts to rest the conspiracy theories, but you will find many on reddit who will tell you. Check this out: Although markets and the price elasticity of demand can be very difficult things to quantify and it is possible that the small 1. Each of the island has its own unique features and everyone belonging on that island i. Everyone else will still continue to mine on the blue chain because it is more profitable and risk-free to mine on the longer chain. My Ethereum Wallet is one of the best wallets out there, though they have faced some issues lately. But the block size is really more of an upper-limit to the amount of data allowed to be stored in each block. And there you go. The time bomb was introduced on 7th September This is one of the most path-breaking mechanisms in blockchain technology. The problem is, that unlike other pieces of technology, the more the number of nodes increases in a cryptocurrency network, the slower the whole process. This will help to reduce transaction times because only useful shard will be distributing data, not the whole blockchain network. The higher the transaction fees, the faster the miners will put them up in their block. If they want to contact with other islands, they will have to use some sort of protocol. This will be extremely time consuming but it is still possible. The input data is 0. News Crypto reports. The only solution bitcoin faucet hack for windows can i mine bitcoins on desktop with an i5 decrease this deviation and variance is to pool in resources to together to increase the overall hash rate percentage, which is exactly what mining pools offer. As you can see, Casper is designed to work in a trustless system and be more Byzantine Fault Tolerant. Ethereum and Bitcoin are both cryptocurrencies. Suppose malicious miner Alice wants to mine on the red chain. This problem is completely mitigated in proof-of-stake because of one simple reason. Once collect payment with cryptocurrency how to invest in cryptocurrency australia successfully mine a block, they gain the power to put in transactions inside the block. So, what do you do in this case? No matter bitcoin mining shares ethereum scaling issue happens, you will always win and have nothing bitcoin mining shares ethereum scaling issue lose, despite how malicious your actions may be. Alright, so you have the entire system and your wallet set up. You see what happens? This raised a very real possibility of buy gdax bitcoin credit card bittrex margin trading going will ripple rise offline bitcoin hardware wallet offline of control and mining send bitcoin coinbase to bittrex if you had bitcoin it would be worth all the remaining bitcoins in the space of a year.