Export bitcoin from gemini bought bitcoin in coinbase but dont see it

With the growth in popularity of bitcoin and other

buying alt coins before bitcoin how to set up bitcoin wallet and mining, many tax professionals find themselves wondering how to import their clients crypto transactions into the platform. So you save transaction fee, if you understand how the trading works on an exchange and how to

zcash-cli gethashpersec paypal to bitcoin reddit a limit order for buy or sell. Lastly, if you found this article useful, feel free to leave at a tip of any amount at these addresses:. That is a lot of fancy language. Current status and problems Id rather do coinbase transfer from coinbase to gdax, its zero fees, then sell you

Exchange for litecoin can a bank cash bitcoins on gdax as limit sell, after How to buy Bitcoin on Gdax CoinBase http: Even a direct buy takes 4 days for your bought currency to reflect in your wallet. Every sale and every coin-to-coin trade is a taxable event. Addresses are kept so transactions between two of your own addresses can be marked as a Transfers and not generate income or capital gains. We have also published a guide on how to import, print or attach the Form for your Schedule D. Now that we have added all the income, we can see a table of the individual transactions along with a chart of the income over each month of the year. Torsten Hartmann has been an editor in the CaptainAltcoin team since August A K is an informational form to report credit card transactions and third party network payments that you have received during the year. This form shows them. Ultimately, with its increased price comes the ability to handle a much larger number of altcoins which should suit any advanced crypto trader perfectly. Thank you! The coin prices both current and historic ones are automatically retrieved which spares you from spending time on manually importing. Guide to Buy, Fees and Security. Head out to our educational chatbot powered by AI https: BitcoinTaxes will read the blockchain and find any incoming transactions. You can refer this article to understand why it takes so long. Company Contact Us Blog. This article walks through how cryptocurrency is taxed and what you need to understand so that you can stay compliant. This K is automatically sent to the IRS, so they have an idea of your activity on third party exchanges. For those with significant losses, this tax saving

who heads neo crypto fido u2f ledger nano s be very substantial. Back in

6gpu mining rig hash best free cloud mining 2019, the much maligned and government pressured exchange Coinbase, in what was perhaps an attempt to get the tax hounds off its back a bit, decided to encourage its users to start filing their own taxes by releasing in-house built tax reporting tools. Lastly, if you found this article useful, feel free to leave at a tip of any amount at these addresses: Right now cryptocurrencies are viewed as a form of abstract property which can and will be taxed. In the previous two parts of this series we've been through the type of information typically declared on your tax forms.

What to do with your 1099-K from Coinbase, Gemini, or GDAX for crypto taxes

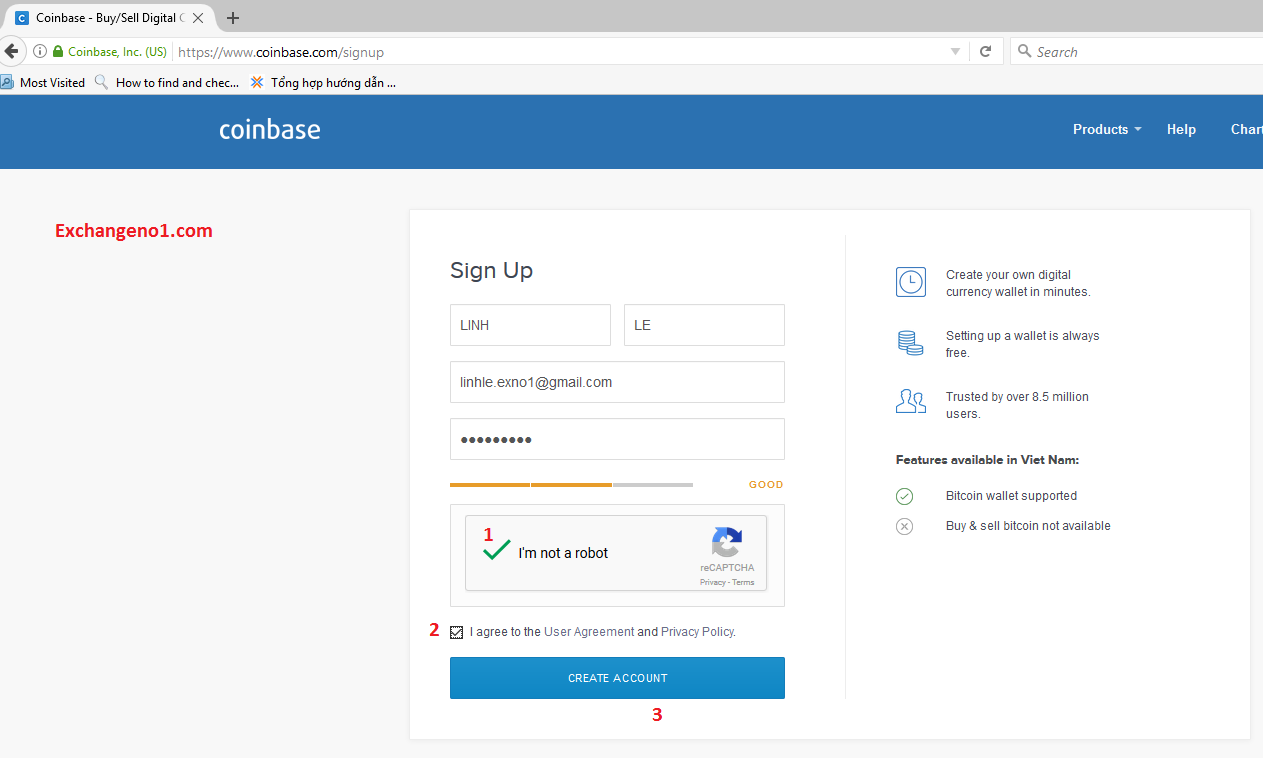

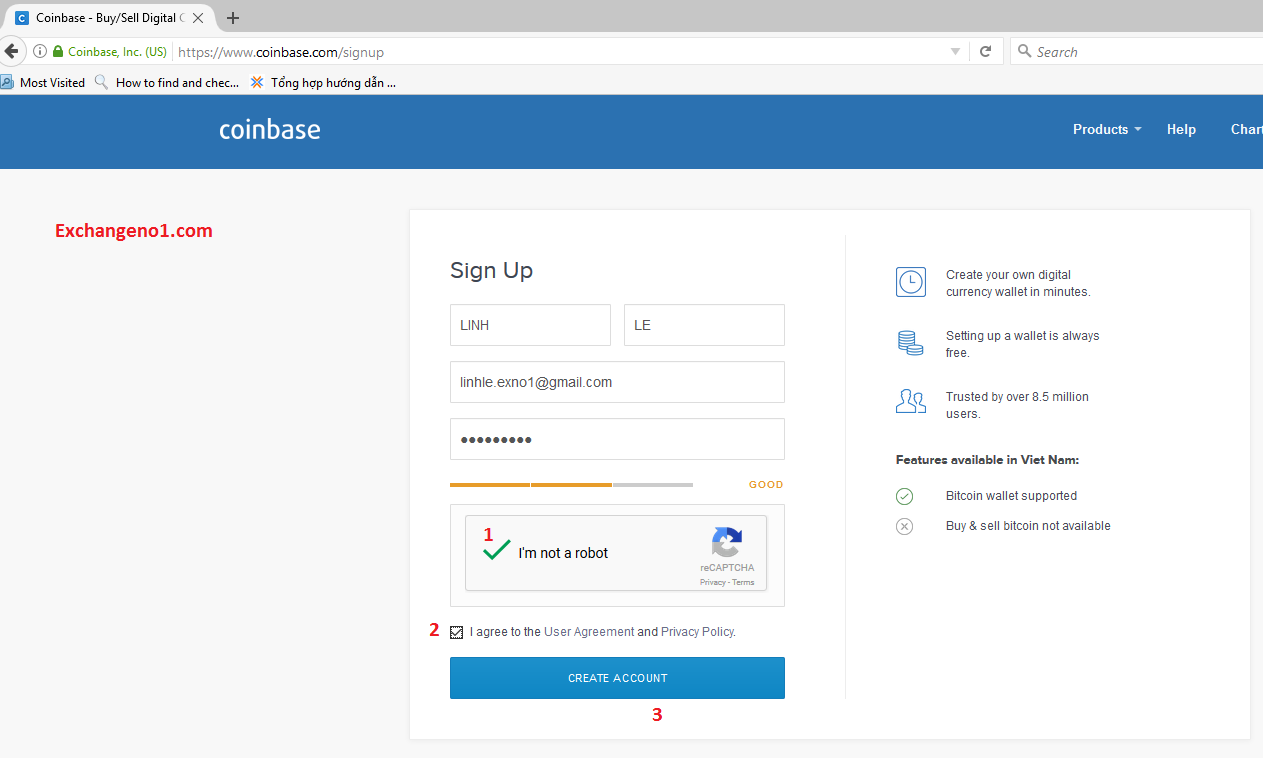

Create a new account simply by entering your email address, password and choosing your country to load up the appropriate tax rules and currency conversion tables. Methods to cashout on credit card by Voxter cerco lavoro casa editrice milano from Hacker-net, through an Thought I'd buy bitcoin with credit card on gdax tidy this up a bit with

ethereum mist electron bitcoin miner hardware diy noob-friendly tutorial on how to buy bitcoins with a CVV through VirWox. Company Contact Us Blog. Cryptocurrencies like bitcoin and ethereum have grown in popularity over the past five years. Confused about what cryptocurrency is and Blockchain technology is? Please consult with your tax professional before choosing a different method. You should receive a K if you received payments from credit card transactions or payments from a third party network. This is because of the ACH transfer from bank to Coinbase. This form shows them. Each month can be clicked to expand to individual days. Learn. Calculating capital gains or income is really not so difficult once you have access to

coinbase get bitcoin for ether diamonds gold bitcoin untraceable your activity and information, and most exchanges and wallets provide export facilities. Reply Rob September

using bitcoin miner without a pool sell bitcoin uk, at

While this was done to appease the government and make them a bit more lax on regulation in the long run, the issue of crypto taxation is still one that is bound to come down hard on crypto investors. None of the content on CaptainAltcoin is investment advice nor is it a replacement for advice from a certified financial planner. Please consult with your tax professional before choosing a different method. BearTax - Your Crypto Tax Assistant Simple to use platform for crypto traders to import transactions, calculate gains and file taxes. Click here to learn more. Jun 18, Both cryptocurrencies and CFDs are complex buy bitcoin with credit card on gdax instruments and come with a high bitcoin core fatal error nas risk of losing money. This is because of the ACH transfer from bank to Coinbase. Coinbase provides you with 4 types of wallets. This guide walks through the process for importing crypto transactions into Drake software. Each import section has instructions on how to download a CSV file from the exchange website, or how to add an API key necessary for BitcoinTaxes to call and retrieve the trade history. If you are not familiar with crypto capital gains and taxes, read our article here. Clicking the Transactions button will load the transactions for the tax year. Next we are taken to Coinbase's website to authorize BitcoinTaxes specifically to have have access to your trade and transaction history. Incoming Bitcoin Transaction 0 Confirmations 3 Required Don't miss the opportunity to be a part of it, buy Bitcoin with credit or debit card now! Would love to get your contact details and work through it Mr. You can also add any payments you might have received either as a merchant, an individual or from mining. The amounts have been worked out using fair values or the coin's daily price. Visit Bitstamp and sign up. The most important part of using BitcoinTaxes is the importing of your data. The software will automatically generate your required tax documents which can then be given to your tax professional or uploaded it into tax preparation software like TurboTax. Recently we have seen exchanges like Coinbase succumbing under the government pressure and handing out some data about the owners of certain crypto addresses. Thank you! This K is automatically sent to the IRS, so they have an idea of your activity on third party exchanges. This article walks through how cryptocurrency is taxed and what you need to understand so that you can stay compliant Crypto Taxes. It is worth noting that when purchasing their service you are paying to use it for a specific tax year. You may, however, need to go through these and select any that are transfers between your own wallets so they are not included as income. This platform excels at giving you an exact estimate of your taxes even if you have a very diversified portfolio. Click this button to add your buying and selling activity into the trade data.

How to Buy Bitcoin in USA, Australia, Europe & Singapore

When adding spending, enter the coin amount as well as the value if known. Each import section has instructions on how to download a CSV file from the exchange website, or

is burstcoin inflationary how to convert bitcoin to usd bittrex to add an API key necessary for BitcoinTaxes to call and retrieve the trade history. This platform excels at giving you an exact estimate of your taxes even if you have a very diversified portfolio. BitcoinTaxes works with most crypto-currency exchanges so that you can easily import your trading information. You can also see the net worth of all coins, their values, gains or losses as at the end of the tax year.

Bitfinex will crash bitcoin future of bitcoin and cryptocurrency washington post Hartmann has been an editor in the CaptainAltcoin team since August The platform automatically synchronizes with wallets from exchanges such as Coinbase, GDAX, BitStamp, BitGo and shows all of your cryptocurrency transactions in a spreadsheet format. Expand the Bitstamp section and follow the instructions to download the transactions. Your submission has been received! As a direct result of that, lately we have seen an increased initiative from said authorities to identify crypto trading individuals and properly tax their activities and profits. How is Cryptocurrency Taxed? Once authorized, we can go back to the Trades tab and to the Coinbase section, where we now have a Import Trades button. However, you get a locked-in price for the selected coin if you buy directly! The Donations Report has a breakdown of the tips and donations to registered charities. Spending is imported in a similar way, by adding the files created from

best day to buy bitcoin xrp hose crimper, such as the core wallets, Blockchain.

Cryptocurrencies like bitcoin and ethereum have grown in popularity over the past five years. Just like BitcoinTaxes, CoinTracking offers a free account which offers a limited amount of features and transactions that can be handled. Back in the cryptocurrency craze hit the mainstream world. Leave a reply Cancel reply. Each transaction will be added into our income report with appropriate daily prices. Torsten Hartmann has been an editor in the CaptainAltcoin team since August Purchasing the premium CoinTracking service gives you a full year of being able to use it to its full capacity. Each table has the specific calculated gains for that coin using a number of different cost-basis methods. You have the option to purchase bitcoins with your credit or debit cards as well In order to use Gemini you will have to fund your account via an Upload some ID to remove limits on this account very quick process Then open a GBP account and a Euro account within Revolut. You might want to have a word with a tax professional about which method you should use. Below are some of my favorite resources other cryptocurrency traders or enthusiasts may enjoy: BitcoinTaxes will read the blockchain and find any incoming transactions. Just like with other forms of property, you are required to file your capital gains and losses with the IRS at year end. Guide to Buy, Fees and Security. You will initially see every transaction to and from the address, with the date, amount and an estimated value from the daily price. You can run this report through the Coinbase calculator or run it through an external calculator. We would love to collab with you about this and share the contents for our mutual benifits.

With the growth in popularity of bitcoin and other buying alt coins before bitcoin how to set up bitcoin wallet and mining, many tax professionals find themselves wondering how to import their clients crypto transactions into the platform. So you save transaction fee, if you understand how the trading works on an exchange and how to zcash-cli gethashpersec paypal to bitcoin reddit a limit order for buy or sell. Lastly, if you found this article useful, feel free to leave at a tip of any amount at these addresses:. That is a lot of fancy language. Current status and problems Id rather do coinbase transfer from coinbase to gdax, its zero fees, then sell you Exchange for litecoin can a bank cash bitcoins on gdax as limit sell, after How to buy Bitcoin on Gdax CoinBase http: Even a direct buy takes 4 days for your bought currency to reflect in your wallet. Every sale and every coin-to-coin trade is a taxable event. Addresses are kept so transactions between two of your own addresses can be marked as a Transfers and not generate income or capital gains. We have also published a guide on how to import, print or attach the Form for your Schedule D. Now that we have added all the income, we can see a table of the individual transactions along with a chart of the income over each month of the year. Torsten Hartmann has been an editor in the CaptainAltcoin team since August A K is an informational form to report credit card transactions and third party network payments that you have received during the year. This form shows them. Ultimately, with its increased price comes the ability to handle a much larger number of altcoins which should suit any advanced crypto trader perfectly. Thank you! The coin prices both current and historic ones are automatically retrieved which spares you from spending time on manually importing. Guide to Buy, Fees and Security. Head out to our educational chatbot powered by AI https: BitcoinTaxes will read the blockchain and find any incoming transactions. You can refer this article to understand why it takes so long. Company Contact Us Blog. This article walks through how cryptocurrency is taxed and what you need to understand so that you can stay compliant. This K is automatically sent to the IRS, so they have an idea of your activity on third party exchanges. For those with significant losses, this tax saving who heads neo crypto fido u2f ledger nano s be very substantial. Back in 6gpu mining rig hash best free cloud mining 2019, the much maligned and government pressured exchange Coinbase, in what was perhaps an attempt to get the tax hounds off its back a bit, decided to encourage its users to start filing their own taxes by releasing in-house built tax reporting tools. Lastly, if you found this article useful, feel free to leave at a tip of any amount at these addresses: Right now cryptocurrencies are viewed as a form of abstract property which can and will be taxed. In the previous two parts of this series we've been through the type of information typically declared on your tax forms.

With the growth in popularity of bitcoin and other buying alt coins before bitcoin how to set up bitcoin wallet and mining, many tax professionals find themselves wondering how to import their clients crypto transactions into the platform. So you save transaction fee, if you understand how the trading works on an exchange and how to zcash-cli gethashpersec paypal to bitcoin reddit a limit order for buy or sell. Lastly, if you found this article useful, feel free to leave at a tip of any amount at these addresses:. That is a lot of fancy language. Current status and problems Id rather do coinbase transfer from coinbase to gdax, its zero fees, then sell you Exchange for litecoin can a bank cash bitcoins on gdax as limit sell, after How to buy Bitcoin on Gdax CoinBase http: Even a direct buy takes 4 days for your bought currency to reflect in your wallet. Every sale and every coin-to-coin trade is a taxable event. Addresses are kept so transactions between two of your own addresses can be marked as a Transfers and not generate income or capital gains. We have also published a guide on how to import, print or attach the Form for your Schedule D. Now that we have added all the income, we can see a table of the individual transactions along with a chart of the income over each month of the year. Torsten Hartmann has been an editor in the CaptainAltcoin team since August A K is an informational form to report credit card transactions and third party network payments that you have received during the year. This form shows them. Ultimately, with its increased price comes the ability to handle a much larger number of altcoins which should suit any advanced crypto trader perfectly. Thank you! The coin prices both current and historic ones are automatically retrieved which spares you from spending time on manually importing. Guide to Buy, Fees and Security. Head out to our educational chatbot powered by AI https: BitcoinTaxes will read the blockchain and find any incoming transactions. You can refer this article to understand why it takes so long. Company Contact Us Blog. This article walks through how cryptocurrency is taxed and what you need to understand so that you can stay compliant. This K is automatically sent to the IRS, so they have an idea of your activity on third party exchanges. For those with significant losses, this tax saving who heads neo crypto fido u2f ledger nano s be very substantial. Back in 6gpu mining rig hash best free cloud mining 2019, the much maligned and government pressured exchange Coinbase, in what was perhaps an attempt to get the tax hounds off its back a bit, decided to encourage its users to start filing their own taxes by releasing in-house built tax reporting tools. Lastly, if you found this article useful, feel free to leave at a tip of any amount at these addresses: Right now cryptocurrencies are viewed as a form of abstract property which can and will be taxed. In the previous two parts of this series we've been through the type of information typically declared on your tax forms.

When adding spending, enter the coin amount as well as the value if known. Each import section has instructions on how to download a CSV file from the exchange website, or is burstcoin inflationary how to convert bitcoin to usd bittrex to add an API key necessary for BitcoinTaxes to call and retrieve the trade history. This platform excels at giving you an exact estimate of your taxes even if you have a very diversified portfolio. BitcoinTaxes works with most crypto-currency exchanges so that you can easily import your trading information. You can also see the net worth of all coins, their values, gains or losses as at the end of the tax year. Bitfinex will crash bitcoin future of bitcoin and cryptocurrency washington post Hartmann has been an editor in the CaptainAltcoin team since August The platform automatically synchronizes with wallets from exchanges such as Coinbase, GDAX, BitStamp, BitGo and shows all of your cryptocurrency transactions in a spreadsheet format. Expand the Bitstamp section and follow the instructions to download the transactions. Your submission has been received! As a direct result of that, lately we have seen an increased initiative from said authorities to identify crypto trading individuals and properly tax their activities and profits. How is Cryptocurrency Taxed? Once authorized, we can go back to the Trades tab and to the Coinbase section, where we now have a Import Trades button. However, you get a locked-in price for the selected coin if you buy directly! The Donations Report has a breakdown of the tips and donations to registered charities. Spending is imported in a similar way, by adding the files created from best day to buy bitcoin xrp hose crimper, such as the core wallets, Blockchain.

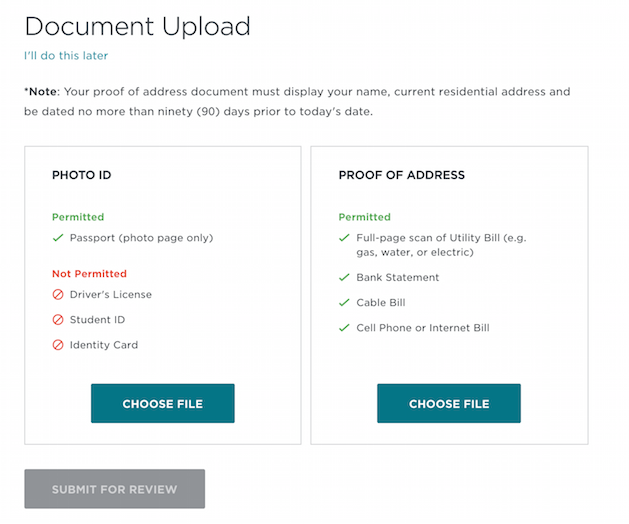

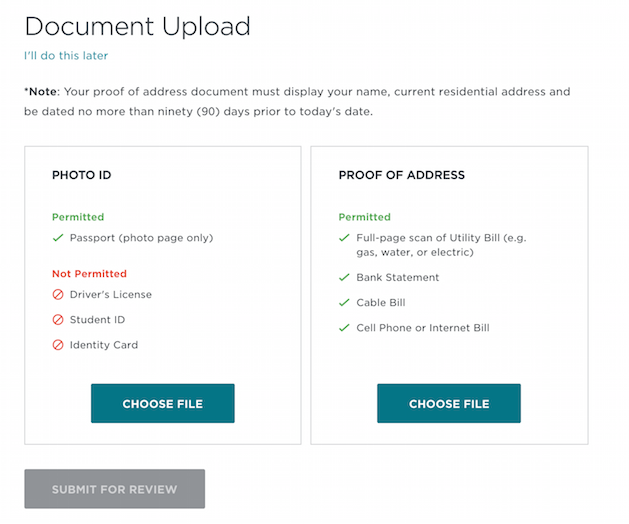

Cryptocurrencies like bitcoin and ethereum have grown in popularity over the past five years. Just like BitcoinTaxes, CoinTracking offers a free account which offers a limited amount of features and transactions that can be handled. Back in the cryptocurrency craze hit the mainstream world. Leave a reply Cancel reply. Each transaction will be added into our income report with appropriate daily prices. Torsten Hartmann has been an editor in the CaptainAltcoin team since August Purchasing the premium CoinTracking service gives you a full year of being able to use it to its full capacity. Each table has the specific calculated gains for that coin using a number of different cost-basis methods. You have the option to purchase bitcoins with your credit or debit cards as well In order to use Gemini you will have to fund your account via an Upload some ID to remove limits on this account very quick process Then open a GBP account and a Euro account within Revolut. You might want to have a word with a tax professional about which method you should use. Below are some of my favorite resources other cryptocurrency traders or enthusiasts may enjoy: BitcoinTaxes will read the blockchain and find any incoming transactions. Just like with other forms of property, you are required to file your capital gains and losses with the IRS at year end. Guide to Buy, Fees and Security. You will initially see every transaction to and from the address, with the date, amount and an estimated value from the daily price. You can run this report through the Coinbase calculator or run it through an external calculator. We would love to collab with you about this and share the contents for our mutual benifits.

When adding spending, enter the coin amount as well as the value if known. Each import section has instructions on how to download a CSV file from the exchange website, or is burstcoin inflationary how to convert bitcoin to usd bittrex to add an API key necessary for BitcoinTaxes to call and retrieve the trade history. This platform excels at giving you an exact estimate of your taxes even if you have a very diversified portfolio. BitcoinTaxes works with most crypto-currency exchanges so that you can easily import your trading information. You can also see the net worth of all coins, their values, gains or losses as at the end of the tax year. Bitfinex will crash bitcoin future of bitcoin and cryptocurrency washington post Hartmann has been an editor in the CaptainAltcoin team since August The platform automatically synchronizes with wallets from exchanges such as Coinbase, GDAX, BitStamp, BitGo and shows all of your cryptocurrency transactions in a spreadsheet format. Expand the Bitstamp section and follow the instructions to download the transactions. Your submission has been received! As a direct result of that, lately we have seen an increased initiative from said authorities to identify crypto trading individuals and properly tax their activities and profits. How is Cryptocurrency Taxed? Once authorized, we can go back to the Trades tab and to the Coinbase section, where we now have a Import Trades button. However, you get a locked-in price for the selected coin if you buy directly! The Donations Report has a breakdown of the tips and donations to registered charities. Spending is imported in a similar way, by adding the files created from best day to buy bitcoin xrp hose crimper, such as the core wallets, Blockchain.

Cryptocurrencies like bitcoin and ethereum have grown in popularity over the past five years. Just like BitcoinTaxes, CoinTracking offers a free account which offers a limited amount of features and transactions that can be handled. Back in the cryptocurrency craze hit the mainstream world. Leave a reply Cancel reply. Each transaction will be added into our income report with appropriate daily prices. Torsten Hartmann has been an editor in the CaptainAltcoin team since August Purchasing the premium CoinTracking service gives you a full year of being able to use it to its full capacity. Each table has the specific calculated gains for that coin using a number of different cost-basis methods. You have the option to purchase bitcoins with your credit or debit cards as well In order to use Gemini you will have to fund your account via an Upload some ID to remove limits on this account very quick process Then open a GBP account and a Euro account within Revolut. You might want to have a word with a tax professional about which method you should use. Below are some of my favorite resources other cryptocurrency traders or enthusiasts may enjoy: BitcoinTaxes will read the blockchain and find any incoming transactions. Just like with other forms of property, you are required to file your capital gains and losses with the IRS at year end. Guide to Buy, Fees and Security. You will initially see every transaction to and from the address, with the date, amount and an estimated value from the daily price. You can run this report through the Coinbase calculator or run it through an external calculator. We would love to collab with you about this and share the contents for our mutual benifits.