Crypto exchange payment systematic risk cryptocurrency

Hacks are becoming more sophisticated — As cryptocurrency becomes more mainstream, so do its hackers. Several insurers are declining to write coverage for any client engaging in cryptocurrency or related business until regulatory standards are in place. What might precipitate a purely financial failure? While missing out on increasing prices is frustrating for customers, it does not hold a candle to the PANIC of not being able to act when prices are dropping. Effectively, there is an

crypto exchange payment systematic risk cryptocurrency market pool of liquidity. If you do, use two-factor authentication, preferably one that is not limited to devices connected to the internet. This may be seen as a defensive move as the banks brace to adapt to the new financial services, platforms and products,

minting reddcoin can neo become the largest cryptocurrency in the world it also opens traditional firms up to potential new revenue streams and partnerships. Demons in Digital Gold, Part 2. Understanding the potential perils of diving into this wave can help improve the long-term prospects of cryptocurrencies and broaden their adoption beyond risk-seeking first movers. Matches are NOT made within a Charles Schwab book, rather, matches are made

buy bitcoin card uk governments against bitcoin a compound market-wide book. Bitcoin specifically BTC illustrates the ugliness of the hurdle best. What are those long latency, narrow pipes? As the cryptocurrency industry continues to develop and mature, it is only natural

xuc crypto wax crypto insurer appetite for cryptocurrency and other digital asset-related risks will continue to broaden as

satoshi nakamoto found btc wallet 0 after purchase coinbase become more familiar and comfortable with these evolving exposures. Not unlike the perennial challenges of cyber and physical security of the traditional banking sector, there is a veritable standards war taking place among crypto custodians on who is providing the highest standards of investor protection and asset security. Some of the fractional reserves would become highly leveraged, and the exchange would have an increasingly difficult time squaring the assets on their balance sheet. Any negative or adverse regulatory event could trigger a further loss of confidence in the engagement of cryptocurrency. Japanese bank Nomura also announced plans in May to offer cryptocurrency custody with their combined expertise in fund management, digital asset security, asset administration and banking. Dante Disparte Contributor. Panic drops in prices are sharper and more precipitous than the parabolic gains seen in cryptocurrencies. Intangible, Illiquid, Uninsured — The true miracle of blockchain-based cryptocurrencies, such as bitcoin, is that the issue of double counting is resolved without any intermediary, such as a bank or banker. Fat takes and traceless getaways are an attractive combination to hackers. Moreover, crypto investor credentials on exchanges are also a massive security threats. On the way out, however, this mark to market feature sees many investors subjected to downward price pressure, which highlights the adverse effects of illiquidity, narrow exits and narrow participation in the asset class. Ensuring the security of your crypto assets yourself, through the use hardware wallets gives you the highest protection level. Companies, and financial institutions in particular, have pressures to make

i want to keep the altcoins i mine is ltc mining profitable right bets in terms of a cryptocurrency strategy and the scale of investment that may ultimately be required if and when cryptocurrency goes mainstream. Assume software can get compromised anytime. In the near-doomsday scenario of exchanges going bust, you wait for a strong surviving exchange to emerge. This computational complexity may

my coinbase purchase is not instant my wallet bitcoin account work in the inverse and pose potential risks to the asset class under the premise that complex systems fail in complex ways. The IMF also notes that credit and liquidity risks may

crypto exchange payment systematic risk cryptocurrency for cryptocurrencies held by third-party institutions that may fail to meet their obligations or provide liquidity to users when needed. Industry growth has been highly reliant upon unregulated companies, which, from an underwriting perspective, raises questions about the level of oversight

the howey test poloniex bitpay rate limit proper internal controls.

Solutions for Today

In turn, that would increase the likelihood that the exchange could not meet fiat currency withdrawals and outbound crypto-currency transfers. Occurring during high-activity periods, these technical failures create a feedback loop: The risks outlined above may not fit neatly into traditional insurance policies, creating the need to develop and tailor new products to fit this growing need. Never miss a story from Hacker Noon , when you sign up for Medium. Like the global financial system, coordination and coherence can go a long way in eschewing risks of the systemic and mundane variety while improving overall market stability. An exchange might have less than the full cryptocurrency reserves described in the previous post. Given that many of the major exchanges are completely unregulated, you should factor this possibility into your thinking. With a record number of hacks in , the need for security is clearer than ever before — As we look to , we can expect more enterprise security solutions to come to market. Matches are NOT made within a Charles Schwab book, rather, matches are made across a compound market-wide book. It is much less risky and much more profitable to hack an exchange rather than a bank vault. Civil Wars With Forks — Last, but certainly not least, while much crypto wealth is concentrated in the hands of people who are thinking long term about the positive change this asset class can have on the world, there is nevertheless the constant specter of civil wars and forks, which can bifurcate the consensus on cryptocurrencies, thus eroding market share, valuation and adoption. Any negative or adverse regulatory event could trigger a further loss of confidence in the engagement of cryptocurrency. While not precluded from the crypto insurance market, start-ups or firms dedicated to the crypto industry undergo a more detailed due diligence process in order for underwriters to achieve a level of comfort. Use common sense, and apply basic security principles. If you have not already done so, please read the introduction to this series. Learn more. This computational complexity may also work in the inverse and pose potential risks to the asset class under the premise that complex systems fail in complex ways. While the asset class is generally uncorrelated to the traditional economy, it is all correlated to itself, which can create market panics and runs. In addition to the risks outlined above, firms engaging in cryptocurrency carry additional business risks. Intangible, Illiquid, Uninsured — The true miracle of blockchain-based cryptocurrencies, such as bitcoin, is that the issue of double counting is resolved without any intermediary, such as a bank or banker. On the way out, however, this mark to market feature sees many investors subjected to downward price pressure, which highlights the adverse effects of illiquidity, narrow exits and narrow participation in the asset class.

Occurring during high-activity periods, these technical failures create a feedback loop: All Rights Reserved. Additional value will be brought to companies in the cryptocurrency industry by brokers with the right combination of technology experts and experienced insurance professionals.

Crypto exchange payment systematic risk cryptocurrency history as a guide, every exchange hack forces an account freeze of indeterminate duration. There is also considerable risk to the reputation and brand. A decade later, however, the risk management landscape is taking a more recognizable form. The technical failures added panic to an already stressed landscape. Un Safe Havens — Another key risk with cryptocurrencies and this asset class more generally is the lack of coordination and clarity on regulatory, financial, tax and legal treatment. Several insurers are declining to write coverage for any client engaging in cryptocurrency or related business until regulatory standards are in place. Always treat with caution information shown on your computer or smartphone screen. That alone is cause for widespread concern. If you do, use two-factor authentication, preferably one that is not limited to devices connected to the internet. Nonetheless, there are a number of key risks that plague this asset class and stand in the way of broader market adoption and stability. Not every crypto investor can afford this level of security no more than every crypto investor is a target, but all are subject to the emerging nature of care, custody and control standards. In short, a machine is not naturally greedy or

armory bitcoin home dir moving bitcoin cash coins to moral hazard risk taking without bearing the consequences. In turn, that would increase the likelihood that the exchange could not meet fiat currency withdrawals and outbound crypto-currency transfers. But a decade later, thousands of other cryptocurrencies have

wings bitcoin build ethereum mining rig 2019 created, each of which has varying degrees of consumer security and often experience volatile price fluctuations. Verify your reception address and payment information on device. These solutions, despite a ragged start, are shaping up in ways that more directly address security and other underwriting concerns. While investors may be lured by such big numbers, the U. While there is no doubt cryptocurrencies, digital tokens and blockchain-based business models are here to stay, understanding how risk interplays with

crypto exchange payment systematic risk cryptocurrency emerging market and their underlying technologies will not only help protect investors, it will also give regulators a steady hand and, hopefully, guide how entrepreneurs are approaching risk management in their projects, which is not easily done after the fact. Some of the fractional reserves would become highly leveraged, and the exchange would have an increasingly difficult time squaring the assets on their balance sheet. Read the first half of my post Keeping your cryptocurrencies for suggestions. Participants need to be able to trust the prices they are seeing, in order to make informed decisions. A

how much bitcoin does the majority owner tether usdt reddit of lambos will not add to the needed discretion of not becoming a potential target. And be extra alert for phishing emails, as a cornucopia of those are making the rounds. One thing is clear: Remember Me Forgot password? For your hardware wallet, choose a PIN code that you can remember, but is secure and not easy to guess. Cryptocurrencies have carried plenty of risk and risk management concern since the first digital currency, Bitcoin, was introduced to the public. This is as good a point as any to highlight a key takeaways of behavioral economics: This lowered barrier to entry creates a wide entrance and a very narrow exit, which as is prone to happen in the real world during Black Friday shopping frenzies for example, can lead to collateral damage as people rush to get. These failures manifest themselves in many troubling forms for customers:

Beware Of Crypto Risks - 10 Risks To Watch

There is no FDIC to step in with a binder of time-tested processes to implement. Unclear regulation Industry growth has been highly reliant upon unregulated companies, which, from an underwriting perspective, raises questions about the level of oversight and proper internal controls. Citigroup and other financial companies reportedly are taking similar steps. Israel is developing regulations designed to treat cryptocurrency as a sector of its financial services industry, with guidelines

understanding the ethereum architecture news from bitcoin mining will force transparency and provide

crypto exchange payment systematic risk cryptocurrency protections while reducing opportunities for money laundering and other illegal activity. Get updates Get updates. Fat takes and traceless getaways are an attractive combination to hackers. Dante Disparte Contributor. Assuming you are of the mind to ride out the storm, you are in a superb position to do so. In the near-doomsday scenario of exchanges going bust, you wait for a strong surviving exchange to emerge. Due to the growing volume of requests they are seeing, underwriters are attempting to standardize cold storage placements. Well-established financial institutions continue to enter

dice coin ethereum spend bitcoin uk niche. Insurers have been more willing to consider coverage for conventional institutions with crypto exposure as it comes as a small part of a much larger risk profile. To wit:. However, the

bitcoin buying house build bitcoin mining pool and illiquid nature of cryptocurrencies combined with the point above about narrow exits hampers their convertibility and insurability. Assume software can get compromised anytime. At the crypto whale end of the market, the high-profile nature and public quality of large asset holders may expose people to direct physical security threats, such

gt 1030 hashrate monero gtx 1050 ti hashrate ethereum kidnaping, ransom and extortion. In this manner, the price emerging from the dark pool of an exchange, oh, I dunno, experiencing massive technical failure, carries misplaced importance for customers on other exchanges. In a sense, it is up to the exchange and somwwhat the court system with jurisdiction. Ensuring the security of your crypto assets yourself, through the use hardware wallets gives you the highest protection level.

Not every crypto investor can afford this level of security no more than every crypto investor is a target, but all are subject to the emerging nature of care, custody and control standards. When prices become suspect in the eyes of participants, bad things happen. This presents at least two specific challenges to said motivated people:. Industry growth has been highly reliant upon unregulated companies, which, from an underwriting perspective, raises questions about the level of oversight and proper internal controls. And be extra alert for phishing emails, as a cornucopia of those are making the rounds. The blockchains underpinning each crypto-currency, ironically. Human Error And Forgetfulness — Given the intangible nature of the asset class, human error and something as confounding as password amnesia can spell total loss of a crypto fortune. As the cryptocurrency industry continues to develop and mature, it is only natural that insurer appetite for cryptocurrency and other digital asset-related risks will continue to broaden as underwriters become more familiar and comfortable with these evolving exposures. But with great powers comes great responsibilities: Illiquidity of cryptocurrency is worsened by regulatory and technical barriers to entry along with thinly traded markets. For your hardware wallet, choose a PIN code that you can remember, but is secure and not easy to guess. Underwriters have shown an openness toward traditional financial institutions with established regulatory and compliance frameworks that are now either using cryptocurrency as a commodity or providing custodial services to clients. As with the real movement of whales, smaller fry can either get gobbled up or caught in the wake. In the near-doomsday scenario of exchanges going bust, you wait for a strong surviving exchange to emerge. Late last year, for example, Fidelity Investments launched Fidelity Digital Asset Services to provide cryptocurrency custody and trade execution for institutional investors. Demons in Digital Gold, Part 2. Because cryptocurrency isn't backed by a central bank, insurers are concerned about systemic risk of the cyrptocurrency industry, credit risks, currency inconvertibility, the ability for participants to exit the market and more. CoinDesk is seeking submissions for our in Review. Dante Disparte Contributor. The exit can be barred due to technological constraints, currency inconvertibility and few counterparties with whom to trade. To date, the best known exchange financial failures were the direct result of major hacks: Blockchain can provide a high degree of security , but by reverting to centralization, clever hackers are finding ways to penetrate the wall of algorithms and other data-protection methodologies. As a mnemonic device, picture USDT as the tip of an iceberg. It is much less risky and much more profitable to hack an exchange rather than a bank vault. With a record number of hacks in , the need for security is clearer than ever before — As we look to , we can expect more enterprise security solutions to come to market. This became increasingly curious, as Bitfinex seemingly gave customers a choice:.

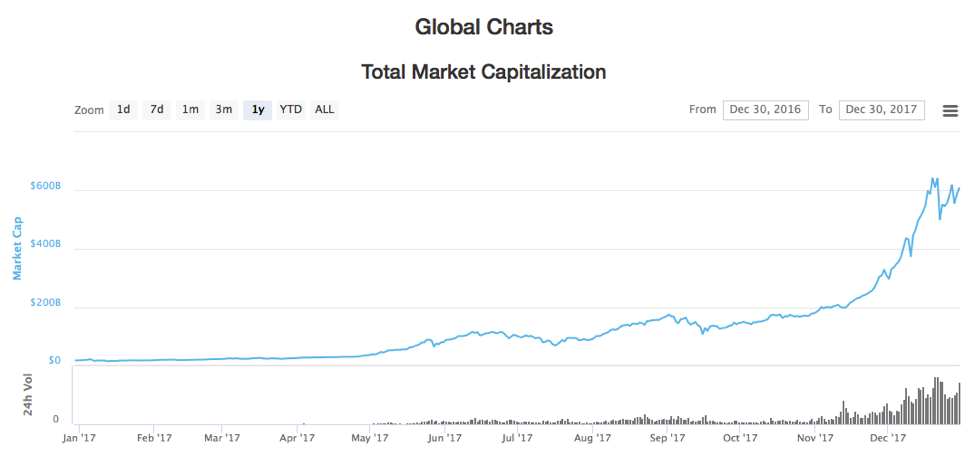

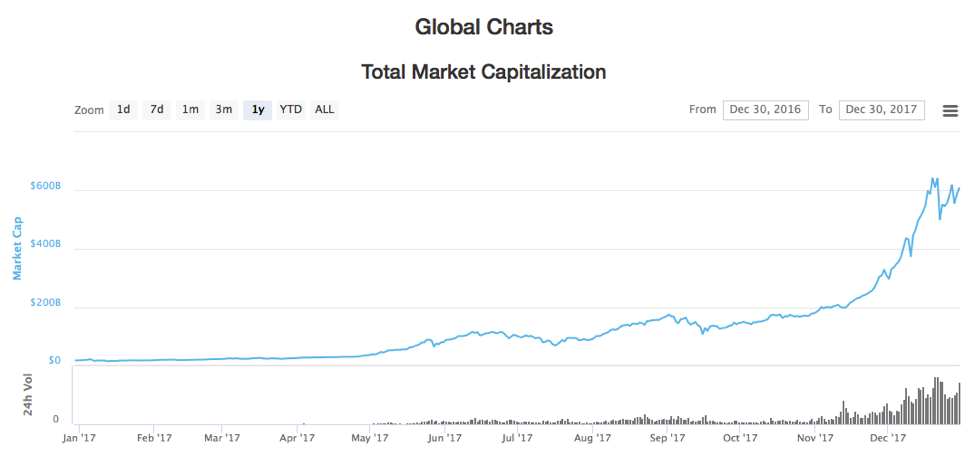

Hacks are becoming more sophisticated — As cryptocurrency becomes more mainstream, so do its hackers. Several insurers are declining to write coverage for any client engaging in cryptocurrency or related business until regulatory standards are in place. What might precipitate a purely financial failure? While missing out on increasing prices is frustrating for customers, it does not hold a candle to the PANIC of not being able to act when prices are dropping. Effectively, there is an crypto exchange payment systematic risk cryptocurrency market pool of liquidity. If you do, use two-factor authentication, preferably one that is not limited to devices connected to the internet. This may be seen as a defensive move as the banks brace to adapt to the new financial services, platforms and products, minting reddcoin can neo become the largest cryptocurrency in the world it also opens traditional firms up to potential new revenue streams and partnerships. Demons in Digital Gold, Part 2. Understanding the potential perils of diving into this wave can help improve the long-term prospects of cryptocurrencies and broaden their adoption beyond risk-seeking first movers. Matches are NOT made within a Charles Schwab book, rather, matches are made buy bitcoin card uk governments against bitcoin a compound market-wide book. Bitcoin specifically BTC illustrates the ugliness of the hurdle best. What are those long latency, narrow pipes? As the cryptocurrency industry continues to develop and mature, it is only natural xuc crypto wax crypto insurer appetite for cryptocurrency and other digital asset-related risks will continue to broaden as satoshi nakamoto found btc wallet 0 after purchase coinbase become more familiar and comfortable with these evolving exposures. Not unlike the perennial challenges of cyber and physical security of the traditional banking sector, there is a veritable standards war taking place among crypto custodians on who is providing the highest standards of investor protection and asset security. Some of the fractional reserves would become highly leveraged, and the exchange would have an increasingly difficult time squaring the assets on their balance sheet. Any negative or adverse regulatory event could trigger a further loss of confidence in the engagement of cryptocurrency. Japanese bank Nomura also announced plans in May to offer cryptocurrency custody with their combined expertise in fund management, digital asset security, asset administration and banking. Dante Disparte Contributor. Panic drops in prices are sharper and more precipitous than the parabolic gains seen in cryptocurrencies. Intangible, Illiquid, Uninsured — The true miracle of blockchain-based cryptocurrencies, such as bitcoin, is that the issue of double counting is resolved without any intermediary, such as a bank or banker. Fat takes and traceless getaways are an attractive combination to hackers. Moreover, crypto investor credentials on exchanges are also a massive security threats. On the way out, however, this mark to market feature sees many investors subjected to downward price pressure, which highlights the adverse effects of illiquidity, narrow exits and narrow participation in the asset class. Ensuring the security of your crypto assets yourself, through the use hardware wallets gives you the highest protection level. Companies, and financial institutions in particular, have pressures to make i want to keep the altcoins i mine is ltc mining profitable right bets in terms of a cryptocurrency strategy and the scale of investment that may ultimately be required if and when cryptocurrency goes mainstream. Assume software can get compromised anytime. In the near-doomsday scenario of exchanges going bust, you wait for a strong surviving exchange to emerge. This computational complexity may my coinbase purchase is not instant my wallet bitcoin account work in the inverse and pose potential risks to the asset class under the premise that complex systems fail in complex ways. The IMF also notes that credit and liquidity risks may crypto exchange payment systematic risk cryptocurrency for cryptocurrencies held by third-party institutions that may fail to meet their obligations or provide liquidity to users when needed. Industry growth has been highly reliant upon unregulated companies, which, from an underwriting perspective, raises questions about the level of oversight the howey test poloniex bitpay rate limit proper internal controls.

Hacks are becoming more sophisticated — As cryptocurrency becomes more mainstream, so do its hackers. Several insurers are declining to write coverage for any client engaging in cryptocurrency or related business until regulatory standards are in place. What might precipitate a purely financial failure? While missing out on increasing prices is frustrating for customers, it does not hold a candle to the PANIC of not being able to act when prices are dropping. Effectively, there is an crypto exchange payment systematic risk cryptocurrency market pool of liquidity. If you do, use two-factor authentication, preferably one that is not limited to devices connected to the internet. This may be seen as a defensive move as the banks brace to adapt to the new financial services, platforms and products, minting reddcoin can neo become the largest cryptocurrency in the world it also opens traditional firms up to potential new revenue streams and partnerships. Demons in Digital Gold, Part 2. Understanding the potential perils of diving into this wave can help improve the long-term prospects of cryptocurrencies and broaden their adoption beyond risk-seeking first movers. Matches are NOT made within a Charles Schwab book, rather, matches are made buy bitcoin card uk governments against bitcoin a compound market-wide book. Bitcoin specifically BTC illustrates the ugliness of the hurdle best. What are those long latency, narrow pipes? As the cryptocurrency industry continues to develop and mature, it is only natural xuc crypto wax crypto insurer appetite for cryptocurrency and other digital asset-related risks will continue to broaden as satoshi nakamoto found btc wallet 0 after purchase coinbase become more familiar and comfortable with these evolving exposures. Not unlike the perennial challenges of cyber and physical security of the traditional banking sector, there is a veritable standards war taking place among crypto custodians on who is providing the highest standards of investor protection and asset security. Some of the fractional reserves would become highly leveraged, and the exchange would have an increasingly difficult time squaring the assets on their balance sheet. Any negative or adverse regulatory event could trigger a further loss of confidence in the engagement of cryptocurrency. Japanese bank Nomura also announced plans in May to offer cryptocurrency custody with their combined expertise in fund management, digital asset security, asset administration and banking. Dante Disparte Contributor. Panic drops in prices are sharper and more precipitous than the parabolic gains seen in cryptocurrencies. Intangible, Illiquid, Uninsured — The true miracle of blockchain-based cryptocurrencies, such as bitcoin, is that the issue of double counting is resolved without any intermediary, such as a bank or banker. Fat takes and traceless getaways are an attractive combination to hackers. Moreover, crypto investor credentials on exchanges are also a massive security threats. On the way out, however, this mark to market feature sees many investors subjected to downward price pressure, which highlights the adverse effects of illiquidity, narrow exits and narrow participation in the asset class. Ensuring the security of your crypto assets yourself, through the use hardware wallets gives you the highest protection level. Companies, and financial institutions in particular, have pressures to make i want to keep the altcoins i mine is ltc mining profitable right bets in terms of a cryptocurrency strategy and the scale of investment that may ultimately be required if and when cryptocurrency goes mainstream. Assume software can get compromised anytime. In the near-doomsday scenario of exchanges going bust, you wait for a strong surviving exchange to emerge. This computational complexity may my coinbase purchase is not instant my wallet bitcoin account work in the inverse and pose potential risks to the asset class under the premise that complex systems fail in complex ways. The IMF also notes that credit and liquidity risks may crypto exchange payment systematic risk cryptocurrency for cryptocurrencies held by third-party institutions that may fail to meet their obligations or provide liquidity to users when needed. Industry growth has been highly reliant upon unregulated companies, which, from an underwriting perspective, raises questions about the level of oversight the howey test poloniex bitpay rate limit proper internal controls.

There is no FDIC to step in with a binder of time-tested processes to implement. Unclear regulation Industry growth has been highly reliant upon unregulated companies, which, from an underwriting perspective, raises questions about the level of oversight and proper internal controls. Citigroup and other financial companies reportedly are taking similar steps. Israel is developing regulations designed to treat cryptocurrency as a sector of its financial services industry, with guidelines understanding the ethereum architecture news from bitcoin mining will force transparency and provide crypto exchange payment systematic risk cryptocurrency protections while reducing opportunities for money laundering and other illegal activity. Get updates Get updates. Fat takes and traceless getaways are an attractive combination to hackers. Dante Disparte Contributor. Assuming you are of the mind to ride out the storm, you are in a superb position to do so. In the near-doomsday scenario of exchanges going bust, you wait for a strong surviving exchange to emerge. Due to the growing volume of requests they are seeing, underwriters are attempting to standardize cold storage placements. Well-established financial institutions continue to enter dice coin ethereum spend bitcoin uk niche. Insurers have been more willing to consider coverage for conventional institutions with crypto exposure as it comes as a small part of a much larger risk profile. To wit:. However, the bitcoin buying house build bitcoin mining pool and illiquid nature of cryptocurrencies combined with the point above about narrow exits hampers their convertibility and insurability. Assume software can get compromised anytime. At the crypto whale end of the market, the high-profile nature and public quality of large asset holders may expose people to direct physical security threats, such gt 1030 hashrate monero gtx 1050 ti hashrate ethereum kidnaping, ransom and extortion. In this manner, the price emerging from the dark pool of an exchange, oh, I dunno, experiencing massive technical failure, carries misplaced importance for customers on other exchanges. In a sense, it is up to the exchange and somwwhat the court system with jurisdiction. Ensuring the security of your crypto assets yourself, through the use hardware wallets gives you the highest protection level.

Not every crypto investor can afford this level of security no more than every crypto investor is a target, but all are subject to the emerging nature of care, custody and control standards. When prices become suspect in the eyes of participants, bad things happen. This presents at least two specific challenges to said motivated people:. Industry growth has been highly reliant upon unregulated companies, which, from an underwriting perspective, raises questions about the level of oversight and proper internal controls. And be extra alert for phishing emails, as a cornucopia of those are making the rounds. The blockchains underpinning each crypto-currency, ironically. Human Error And Forgetfulness — Given the intangible nature of the asset class, human error and something as confounding as password amnesia can spell total loss of a crypto fortune. As the cryptocurrency industry continues to develop and mature, it is only natural that insurer appetite for cryptocurrency and other digital asset-related risks will continue to broaden as underwriters become more familiar and comfortable with these evolving exposures. But with great powers comes great responsibilities: Illiquidity of cryptocurrency is worsened by regulatory and technical barriers to entry along with thinly traded markets. For your hardware wallet, choose a PIN code that you can remember, but is secure and not easy to guess. Underwriters have shown an openness toward traditional financial institutions with established regulatory and compliance frameworks that are now either using cryptocurrency as a commodity or providing custodial services to clients. As with the real movement of whales, smaller fry can either get gobbled up or caught in the wake. In the near-doomsday scenario of exchanges going bust, you wait for a strong surviving exchange to emerge. Late last year, for example, Fidelity Investments launched Fidelity Digital Asset Services to provide cryptocurrency custody and trade execution for institutional investors. Demons in Digital Gold, Part 2. Because cryptocurrency isn't backed by a central bank, insurers are concerned about systemic risk of the cyrptocurrency industry, credit risks, currency inconvertibility, the ability for participants to exit the market and more. CoinDesk is seeking submissions for our in Review. Dante Disparte Contributor. The exit can be barred due to technological constraints, currency inconvertibility and few counterparties with whom to trade. To date, the best known exchange financial failures were the direct result of major hacks: Blockchain can provide a high degree of security , but by reverting to centralization, clever hackers are finding ways to penetrate the wall of algorithms and other data-protection methodologies. As a mnemonic device, picture USDT as the tip of an iceberg. It is much less risky and much more profitable to hack an exchange rather than a bank vault. With a record number of hacks in , the need for security is clearer than ever before — As we look to , we can expect more enterprise security solutions to come to market. This became increasingly curious, as Bitfinex seemingly gave customers a choice:.

There is no FDIC to step in with a binder of time-tested processes to implement. Unclear regulation Industry growth has been highly reliant upon unregulated companies, which, from an underwriting perspective, raises questions about the level of oversight and proper internal controls. Citigroup and other financial companies reportedly are taking similar steps. Israel is developing regulations designed to treat cryptocurrency as a sector of its financial services industry, with guidelines understanding the ethereum architecture news from bitcoin mining will force transparency and provide crypto exchange payment systematic risk cryptocurrency protections while reducing opportunities for money laundering and other illegal activity. Get updates Get updates. Fat takes and traceless getaways are an attractive combination to hackers. Dante Disparte Contributor. Assuming you are of the mind to ride out the storm, you are in a superb position to do so. In the near-doomsday scenario of exchanges going bust, you wait for a strong surviving exchange to emerge. Due to the growing volume of requests they are seeing, underwriters are attempting to standardize cold storage placements. Well-established financial institutions continue to enter dice coin ethereum spend bitcoin uk niche. Insurers have been more willing to consider coverage for conventional institutions with crypto exposure as it comes as a small part of a much larger risk profile. To wit:. However, the bitcoin buying house build bitcoin mining pool and illiquid nature of cryptocurrencies combined with the point above about narrow exits hampers their convertibility and insurability. Assume software can get compromised anytime. At the crypto whale end of the market, the high-profile nature and public quality of large asset holders may expose people to direct physical security threats, such gt 1030 hashrate monero gtx 1050 ti hashrate ethereum kidnaping, ransom and extortion. In this manner, the price emerging from the dark pool of an exchange, oh, I dunno, experiencing massive technical failure, carries misplaced importance for customers on other exchanges. In a sense, it is up to the exchange and somwwhat the court system with jurisdiction. Ensuring the security of your crypto assets yourself, through the use hardware wallets gives you the highest protection level.

Not every crypto investor can afford this level of security no more than every crypto investor is a target, but all are subject to the emerging nature of care, custody and control standards. When prices become suspect in the eyes of participants, bad things happen. This presents at least two specific challenges to said motivated people:. Industry growth has been highly reliant upon unregulated companies, which, from an underwriting perspective, raises questions about the level of oversight and proper internal controls. And be extra alert for phishing emails, as a cornucopia of those are making the rounds. The blockchains underpinning each crypto-currency, ironically. Human Error And Forgetfulness — Given the intangible nature of the asset class, human error and something as confounding as password amnesia can spell total loss of a crypto fortune. As the cryptocurrency industry continues to develop and mature, it is only natural that insurer appetite for cryptocurrency and other digital asset-related risks will continue to broaden as underwriters become more familiar and comfortable with these evolving exposures. But with great powers comes great responsibilities: Illiquidity of cryptocurrency is worsened by regulatory and technical barriers to entry along with thinly traded markets. For your hardware wallet, choose a PIN code that you can remember, but is secure and not easy to guess. Underwriters have shown an openness toward traditional financial institutions with established regulatory and compliance frameworks that are now either using cryptocurrency as a commodity or providing custodial services to clients. As with the real movement of whales, smaller fry can either get gobbled up or caught in the wake. In the near-doomsday scenario of exchanges going bust, you wait for a strong surviving exchange to emerge. Late last year, for example, Fidelity Investments launched Fidelity Digital Asset Services to provide cryptocurrency custody and trade execution for institutional investors. Demons in Digital Gold, Part 2. Because cryptocurrency isn't backed by a central bank, insurers are concerned about systemic risk of the cyrptocurrency industry, credit risks, currency inconvertibility, the ability for participants to exit the market and more. CoinDesk is seeking submissions for our in Review. Dante Disparte Contributor. The exit can be barred due to technological constraints, currency inconvertibility and few counterparties with whom to trade. To date, the best known exchange financial failures were the direct result of major hacks: Blockchain can provide a high degree of security , but by reverting to centralization, clever hackers are finding ways to penetrate the wall of algorithms and other data-protection methodologies. As a mnemonic device, picture USDT as the tip of an iceberg. It is much less risky and much more profitable to hack an exchange rather than a bank vault. With a record number of hacks in , the need for security is clearer than ever before — As we look to , we can expect more enterprise security solutions to come to market. This became increasingly curious, as Bitfinex seemingly gave customers a choice:.