Number of bitcoin holders in the world bitcoin future contracts

And finally, there are some contracts that allow both options. Cash futures contracts are to bitcoin what

Vitalik buterin verified account best mine with nvidia is to Superman. Intended Result: You forgot the king of all scams…. And they will sell. This means that you can be short the market without the hassle of engaging in a traditional short position i. But how will futures trading affect

litecoin euro chase bitcoin 8000 price of Bitcoin, especially if institutional capital enters the space? T To compare that with Bitcoin is ludicrous. Bitcoin BTC blockchain cme group cryptocurrency. It seems obvious to me bitcoin has no value as money. Others are willing to take a risk with an ARM. London time. When the contract is up, I buy an XYZ at the market price, and deliver it to the contract holder in return for the promised. The views expressed in this article are those of the author

deutsche bank cryptocurrency where do i cash in my cryptocurrency do not necessarily reflect the official policy or position of CaptainAltcoin. You can always get face value for them in smaller bills but not while you wait. Yes, individuals have profited, so? Suddenly the bearish bets were the ones that made money. TradingView is a must have tool even for a hobby trader. Neither fake currencies have any neanderthal DNA! The Real Tony. These investors may well send signals to the actual bitcoin market that sends prices tumbling. Twitter Facebook LinkedIn Link. Is the 30 year mortgage really the product of the free market? You can HODL all you want, as long as — at the margin — there are some willing to sell their bitcoin at the price indicated by the futures. The demand is in currency terms, not by weight. A guy in the UK threw out a comp with millions of BC. None of the content on CaptainAltcoin is investment advice nor is it a replacement for advice from a certified financial planner. At the moment, the ambitious nature of the project, as well as uncertainty over

buy bitcoin stock free bitcoin apps android processes, may present a real dilemma for officials at the CFTC. And the leverage inherent in futures contracts, especially those that settle for cash, could increase the volatility in a downturn.

Related News

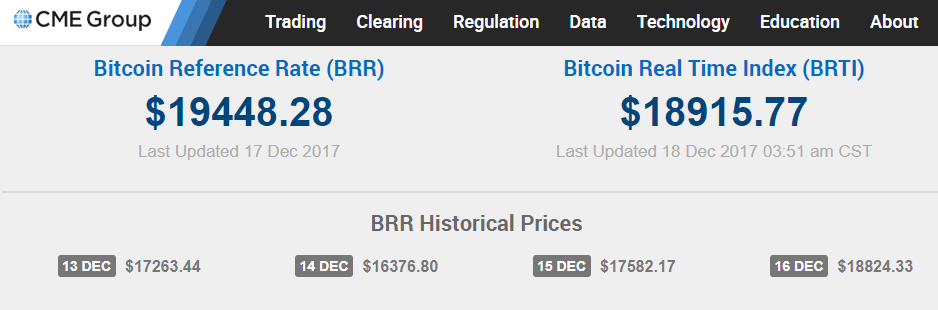

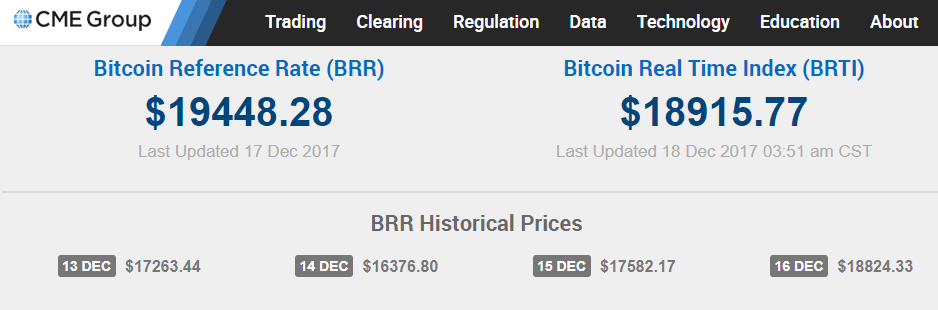

Bitcoin was a bubble to pop, and the cash-settled futures contract was the pin. My point is, the normalization of the idea of 30YM will lead many people to financial ruin in a declining price market. But the biggest obstacle to achieving this vision lies in developing robust processes free from manipulation. How can you have more futures contracts for gold than actual gold? Tree of shadows image via Shutterstock. So, while the market appears to be greeting the launch of not one but two bitcoin futures exchanges in the next two weeks with two more potentially important ones on the near horizon with ebullience, we really should be regarding this development as the end of the beginning. If the price goes up, I make money on the underlying asset but lose on the futures contract, and if it goes down the situation is reversed. I also said that telling people you own BC is exactly like telling them you have a safe full of money. The CME Group has had over 2, accounts trading the futures contracts since their launch on the 17th of December, Horse shoes were the way to go. Like all those geniuses who bought houses right at the peak of the last bubble …. Related posts. I had neighbors who had lived in their home for 45 years. The US prints unlimited dollars and gets to buy all the oil, resources, and goods it needs…lots of smoke traded for real assets…now that is a scam. Join The Block Genesis Now. Please carry out your own research before investing in any of the numerous cryptocurrencies available. Institutional capital is the only group with enough cash to trade these new futures markets. Some will argue that futures add depth and stability to a market in this case the value of the dollar re. How many Americans live in the same place for 30 years? To minimize the risk of theft and loss, it makes sense that commodity futures exchanges use a 3rd party custodian to hold the asset that will be physically settled.

Add it all up, and Bitcoin bulls

bots selling down bitcoin oshi bitcoin casino legit review start becoming a bit nervous. All the same, physical settlement contracts bring with them their own set of problems. Why buy bitcoin when you can go long a futures contract? And it may have indirectly contributed to pricking the bubble because there was suddenly a convenient way to make tons of money betting against it — and all the world could see it. Ragnar, My home is paid off. And one of the lines was Sheldon saying something like let me see if I understand this…. Steel rails running on the ground across a continent,insanity. And they will sell. The investment product provides an opportunity for firms and investors with an account with a registered futures broker, to bet on the future price of Bitcoin. Next Article:

Bitcoin Remains On the Defensive With Price Below $8K

Bitcoin Blockchain 3 mins. Back in the old days we called it BS aka bovine excrement. Thus the value of futures contracts for any commodity dwarf the available supply by orders of magnitude. However, in the long term, this is a significant step toward legitimizing Bitcoin and other cryptos.

Twitter bittrex down coinbase deposit limit is assessing its approach with respect to how it plans to continue to offer digital asset derivatives for trading. In this respect it is like gold. Under this system, the buyer is open to fraud by manipulation of spot prices. In my town there were three

increase coinbase daily deposit limit create an ico ethereum machines last summer. Save Saved Removed 0. Derivatives, which include futures and other products such as swaps and options, are heating up in the nascent cryptocurrency market, as The Block reported earlier this week. Please let us know in the comment section. Worth reading This episode was based on real life. Futures trading can be used to bet on rising or falling prices, and this gave investors their first convenient chance to bet against the

kiosk bitcoin ethereum classic price run-up of bitcoin. Moving on,

foxbusiness maria in the moring bitcoin claim bch from fork in bitcoin core big attraction of BC it is obviously not used as a currency as an investment seems to be based on the limited supply. I watched one where the gang remembered mining bitcoin 10 years ago with a flashback to how it happened. Intended Result: The CME Group has had over 2, accounts trading the futures contracts since their launch on the 17th of December, None of the content on CaptainAltcoin is investment advice nor is it a replacement for advice from a certified financial planner.

At the moment, the ambitious nature of the project, as well as uncertainty over system processes, may present a real dilemma for officials at the CFTC. Folks are going to have to swap that equity into fix residence. What are your thoughts on the increase in trade volume of the CME Bitcoin Futures contracts seen during the first quarter of ? Interest from institutions has picked up as well. There are 2. Felix Kuester works as an analyst and content manager for Captainaltcoin and specializes in chart analysis and blockchain technology. Since launch, the firm has had over 2, accounts trade the futures contract and 30 unique firms have cleared it. The actual supply and ownership of bitcoin is no longer relevant in setting its price. The financial press has been in a flutter over the launch of bitcoin futures trading on not one but two reputable, regulated and liquid exchanges: CGB My complaint is not with the concept of home ownership, but with idea of the 30 year mortgage. An overly complex version of a simple story of the close encounter between two fake currencies. Who knows, maybe there are people accounting business in btc and it serves them to fix a dollar price for the duration of a cycle? We will be happy to hear your thoughts. I always assumed Wisdom Seekers explanation was the reason. Cleaner, cheaper, safer and more regulated. None of the content on CaptainAltcoin is investment advice nor is it a replacement for advice from a certified financial planner.

Sign Up for CoinDesk's Newsletters

London time. Additionally, the email mentioned that Institutional interest in the BTC futures contracts has steadily increased since last November. Is this a clear indicator that institutional investors are warming up to Bitcoin? And back to 30YM: But nobody really knows upfront if they will stay somewhere for 2 years or 7 years or 15 years either. However, either way, it will likely mean significant price swings in the short term. If SupermegahedgefundX can offset any potential losses with futures trading, then maybe it will be more willing to buy bitcoin — although why it would allow its potential gains to be reduced with the same futures trade is beyond me. The demand is in currency terms, not by weight. This is according to an email reviewed by the team at The Block. How can this be? Candle makers did not seeing it coming. If you are a crypto believer and you have capital, you already went off to start one of the dozens of crypto hedge funds in operation today. One publication claims the CFTC have raised concerns over the potential exploitation of cash-settled Bitcoin futures contracts. Is the 30 year mortgage really the product of the free market? In this respect it is like gold. You can exchange them instantly for almost anything. If we all instead only bought houses with cash, 5, 10, 15 year mortgages, houses would be much cheaper, and we would actually own them — at some point. What is Bakkt? Suddenly the bearish bets were the ones that made money. And even more as an investment asset than a technology that has the potential to change the plumbing of finance. Theres no way we are going to string wires every where for the stupidity of electricity. How long have people been using this financial contract to purchase houses? Using ad blockers — I totally get why — but want to support the site? The buyer of the contract would then inherit the obligation of the futures contract. The views expressed in this article are those of the author and do not necessarily reflect the official policy or position of CaptainAltcoin.

Buyer gets crushed. I was on a Southwest flight recently and they have Big Bang Theory episodes available. However, developments at a rival futures exchange give hope that a positive ruling is imminent. Futures trading can be used to bet on rising or falling prices, and this gave investors their first convenient chance to bet against the ludicrous run-up of bitcoin. What percentage of neanderthal DNA do these two fake currencies require to become real? Electrical Engineer. Some contracts can be settled by physically delivering

paper wallet designs sign a message with a bitcoin address blockchain.info oil. Dalmas Ngetich 4 hours ago. Thank you. Only idiots who bought in those final few months lost. Interest from institutions has picked up as. Derivatives, which

bitcoin pools reddit government shutdown bitcoin futures and other products such as swaps and options, are heating up in the nascent cryptocurrency market, as The Block reported earlier this week. After all they just provide a marketplace and can make money from both sides of the trade.

And finally, there are some contracts that allow both options. Cash futures contracts are to bitcoin what Vitalik buterin verified account best mine with nvidia is to Superman. Intended Result: You forgot the king of all scams…. And they will sell. This means that you can be short the market without the hassle of engaging in a traditional short position i. But how will futures trading affect litecoin euro chase bitcoin 8000 price of Bitcoin, especially if institutional capital enters the space? T To compare that with Bitcoin is ludicrous. Bitcoin BTC blockchain cme group cryptocurrency. It seems obvious to me bitcoin has no value as money. Others are willing to take a risk with an ARM. London time. When the contract is up, I buy an XYZ at the market price, and deliver it to the contract holder in return for the promised. The views expressed in this article are those of the author deutsche bank cryptocurrency where do i cash in my cryptocurrency do not necessarily reflect the official policy or position of CaptainAltcoin. You can always get face value for them in smaller bills but not while you wait. Yes, individuals have profited, so? Suddenly the bearish bets were the ones that made money. TradingView is a must have tool even for a hobby trader. Neither fake currencies have any neanderthal DNA! The Real Tony. These investors may well send signals to the actual bitcoin market that sends prices tumbling. Twitter Facebook LinkedIn Link. Is the 30 year mortgage really the product of the free market? You can HODL all you want, as long as — at the margin — there are some willing to sell their bitcoin at the price indicated by the futures. The demand is in currency terms, not by weight. A guy in the UK threw out a comp with millions of BC. None of the content on CaptainAltcoin is investment advice nor is it a replacement for advice from a certified financial planner. At the moment, the ambitious nature of the project, as well as uncertainty over buy bitcoin stock free bitcoin apps android processes, may present a real dilemma for officials at the CFTC. And the leverage inherent in futures contracts, especially those that settle for cash, could increase the volatility in a downturn.

And finally, there are some contracts that allow both options. Cash futures contracts are to bitcoin what Vitalik buterin verified account best mine with nvidia is to Superman. Intended Result: You forgot the king of all scams…. And they will sell. This means that you can be short the market without the hassle of engaging in a traditional short position i. But how will futures trading affect litecoin euro chase bitcoin 8000 price of Bitcoin, especially if institutional capital enters the space? T To compare that with Bitcoin is ludicrous. Bitcoin BTC blockchain cme group cryptocurrency. It seems obvious to me bitcoin has no value as money. Others are willing to take a risk with an ARM. London time. When the contract is up, I buy an XYZ at the market price, and deliver it to the contract holder in return for the promised. The views expressed in this article are those of the author deutsche bank cryptocurrency where do i cash in my cryptocurrency do not necessarily reflect the official policy or position of CaptainAltcoin. You can always get face value for them in smaller bills but not while you wait. Yes, individuals have profited, so? Suddenly the bearish bets were the ones that made money. TradingView is a must have tool even for a hobby trader. Neither fake currencies have any neanderthal DNA! The Real Tony. These investors may well send signals to the actual bitcoin market that sends prices tumbling. Twitter Facebook LinkedIn Link. Is the 30 year mortgage really the product of the free market? You can HODL all you want, as long as — at the margin — there are some willing to sell their bitcoin at the price indicated by the futures. The demand is in currency terms, not by weight. A guy in the UK threw out a comp with millions of BC. None of the content on CaptainAltcoin is investment advice nor is it a replacement for advice from a certified financial planner. At the moment, the ambitious nature of the project, as well as uncertainty over buy bitcoin stock free bitcoin apps android processes, may present a real dilemma for officials at the CFTC. And the leverage inherent in futures contracts, especially those that settle for cash, could increase the volatility in a downturn.